Corrs Company began operations in 2024 and determined its ending inventory at cost and at lower-of-LIFO cost-or-market

Question:

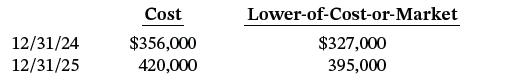

Corrs Company began operations in 2024 and determined its ending inventory at cost and at lower-of-LIFO cost-or-market at December 31, 2024, and December 31, 2025. This information is presented below.

Instructions

a. Prepare the journal entries required at December 31, 2024, and December 31, 2025, assuming that the inventory is recorded at market, and a perpetual inventory system (cost-of-goods-sold method) is used.

b. Prepare journal entries required at December 31, 2024, and December 31, 2025, assuming that the inventory is recorded at market under a perpetual system (loss method is used).

c. Which of the two methods above provides the higher net income in each year?

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield