During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All

Question:

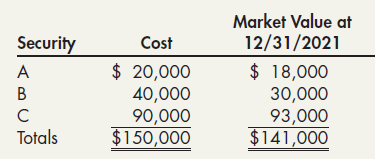

During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows:

The net holding gain or loss included in Anthony’s income statement for the year should be:

a. $0

b. $3,000 gain

c. $9,000 loss

d. $12,000 loss

Transcribed Image Text:

Market Value at 12/31/2021 Security Cost $ 20,000 40,000 90,000 $150,000 $ 18,000 30,000 93,000 $141,000 B Totals

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (14 reviews)

c 1...View the full answer

Answered By

Benish Ahmad

I'm a professional software engineer. I'm lectutrer at GCUF and I have 3 years of teaching experience. I'm looking forward to getting mostly computer science work including:

Programming fundamentals

Object oriented programming

Data structures

object oriented design and analysis

Database system

Computer networks

Discrete mathematics

Web application

I am expert in different computer languages such as C++, java, JavaScript, Sql, CSS, Python and C#. I'm also have excellent knowledge of essay writing and research. I have worked in other Freelancing website such as Fiverr and Upwork. Now I have finally decided to join the SolutionInn platform to continue with my explicit work of helping dear clients and students to achieve their academic dreams. I deliver plagiarism free work and exceptional projects on time. I am capable of working under high pressure.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted:

Students also viewed these Business questions

-

On January 1, the company purchased debt securities with a face value of $100,000. The securities mature in seven years. The securities have a stated interest rate of 8%, and interest is paid...

-

On January 1, the company purchased debt securities for cash of $25,518. The securities have a face value of $20,000, and they mature in 15 years. The securities have a stated interest rate of 10%,...

-

(Multiple Choice) 1. On its December 31, 2006 balance sheet, Fay Company appropriately reported a $2,000 credit balance in its Allowance for Change in Value of Investment. There was no change during...

-

Aquarius -EAST B Capricornus Horizon Sagittarius SOUTH SUN Scorpius Libra WEST- E Description: If you could see both the Sun and the other stars during the day, this is what the sky would look like...

-

Calculate the maximum possible efficiency of a heat engine that uses surface lake water at 18.0C as a source of heat and rejects waste heat to the water 0.100 km below the surface where the...

-

The adjusted trial balance for Lloyd Construction as of December 31, 2023, follows: An analysis of other information reveals that Lloyd Construction is required to make a $41,500 payment on the...

-

(c) From the output of the analysis performed in Section (b), obtain the following: (i) an estimate of the variance component for family (ii) an estimate of the residual variance component. Obtain...

-

Beck Manufacturing reports the information below for 2015. Using this information: 1. Prepare the schedule of cost of goods manufactured for the year. 2. Compute cost of goods sold for the year. Raw...

-

What is the yield to maturity of a 25 year zero coupon bond quoted at 38.87? (3 decimal places)

-

The duobinary, ternary, and bipolar signaling techniques have one common feature: They all employ three amplitude levels. In what way does the duobinary technique differ from the other two?

-

On January 1, 2019, Weaver Company purchased as held-to-maturity debt securities $500,000 face value of Park Corporations 8% bonds for $456,200. The bonds were purchased to yield 10% interest and pay...

-

On July 1, 2019, Aldrich Company purchased as an available-for-sale security $200,000 face value, 9% U.S. Treasury notes for $194,000. The notes mature July 1, 2020, and pay interest semiannually on...

-

Rejoice, Inc., a private foundation, has existed for 10 years. Rejoice held undistributed income of $160,000 at the end of its 2020 tax year. Of this amount, $90,000 was distributed in 2021, and...

-

Question (4) seen, 20 vehicles/km moving at 100 km/h and 30 vehicles/km traveling at 120 km/h. Two successive videos showing stationary traffic on the road were examined. Two groups of platoons were...

-

?In civil engineering, what is the main use of a slump test in concrete technology?

-

Explain the process of compression resin transfer molding(CRTM)?in composite manufacturing. What are the benefits of using CRTM for producing composite structures?

-

Explore the role of post-occupancy evaluation in commercial and industrial architecture. How do architects use feedback from building users to improve future designs?

-

Discuss the principles of geotechnical engineering in slope stability analysis. How can engineers assess slope stability, mitigate landslide risks, and design effective stabilization measures to...

-

Solve the linear programming problems in Problem using the simplex method. P = 10x + 50x2 + 10x3 3x, + 3x, + 3x, s 66 6x1 Maximize %3D subject to 2r2 + 4x3 s 48 3x1 + 6x2 + 9x3 s 108 X1, X2, X3 2

-

Consider the circuit of Fig. 7.97. Find v0 (t) if i(0) = 2 A and v(t) = 0. 1 3 ett)

-

From inception of operations in 2010, Summit carried no allowance for doubtful accounts. Uncollectible receivables were expensed as written-off, and recoveries were credited to income as collected....

-

On September 30, 2013 (the end of its fiscal year), Lufkin Corporation reported accounts receivable of $331,750 and an allowance for doubtful accounts of $16,700. During fiscal 2014, the following...

-

Obtain The Coca-Cola Company's 2010 annual report either using the ''Investor Relations'' portion of its website (do a web search for Coca-Cola investor relations) or go to www.sec.gov and click...

-

Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $11,100. He is single and claims 1 deduction. Before this payroll, Barretts cumulative...

-

Bass Accounting Services expects its accountants to work a total of 26,000 direct labor hours per year. The company's estimated total indirect costs are $ 260,000. The company uses direct labor hours...

-

The Balance Sheet has accounts where the accountant must make estimates. Some situations in which estimates affect amounts reported in the balance sheet include: Allowance for doubtful accounts....

Study smarter with the SolutionInn App