E5-17 (L03,5) (Preparation of a Statement of Cash Flows and a Balance Sheet) Grant Wood Corporations balance

Question:

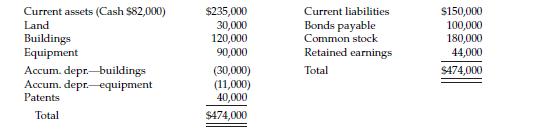

E5-17 (L03,5) (Preparation of a Statement of Cash Flows and a Balance Sheet) Grant Wood Corporation’s balance sheet at the end of 2016 included the following items.

The following information is available for 2017.

1. Net income was $55,000.

2. Equipment (cost $20,000 and accumulated depreciation $8,000) was sold for $10,000.

3. Depreciation expense was $4,000 on the building and $9,000 on equipment.

4. Patent amortization was $2,500.

5. Current assets other than cash increased by $29,000. Current liabilities increased by $13,000.

6. An addition to the building was completed at a cost of $27,000.

7. A long-term investment in stock was purchased for $16,000.

8. Bonds payable of $50,000 were issued.

9. Cash dividends of $30,000 were declared and paid.

10. Treasury stock was purchased at a cost of $11,000.

Instructions (Show only totals for current assets and current liabilities.)

(a) Prepare a statement of cash flows for 2017.

(b) Prepare a balance sheet at December 31, 2017.

Step by Step Answer: