E8-19 (L03,4) (Alternative Inventory MethodsComprehensive) Tori Amos Corporation began operations on December 1, 2016. The only inventory

Question:

E8-19 (L03,4) (Alternative Inventory Methods—Comprehensive) Tori Amos Corporation began operations on December 1, 2016. The only inventory transaction in 2016 was the purchase of inventory on December 10, 2016, at a cost of $20 per unit.

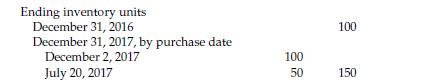

None of this inventory was sold in 2016. Relevant information is as follows.

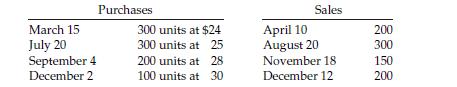

During the year, the following purchases and sales were made.

The company uses the periodic inventory method.

Instructions

(a) Determine ending inventory under (1) specific identification, (2) FIFO, (3) LIFO, and (4) average-cost.

(b) Determine ending inventory using dollar-value LIFO. Assume that the December 2, 2017, purchase cost is the current cost of inventory. (Hint: The beginning inventory is the base layer priced at $20 per unit.)

Step by Step Answer: