Early in January 2026, Hopkins Company is preparing for a meeting with its bankers to discuss a

Question:

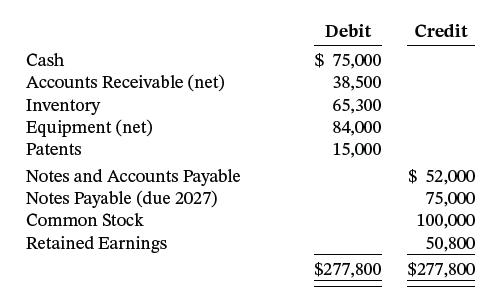

Early in January 2026, Hopkins Company is preparing for a meeting with its bankers to discuss a loan request. Its bookkeeper provided the following accounts and balances at December 31, 2025.

Except for the following items, Hopkins has recorded all adjustments in its accounts.

1. Cash includes $500 petty cash and $15,000 in a bond sinking fund.

2. Net accounts receivable is comprised of $52,000 in accounts receivable and $13,500 in allowance for doubtful accounts.

3. Equipment had a cost of $112,000 and accumulated depreciation of $28,000.

4. On January 8, 2026, one of Hopkins’ customers declared bankruptcy. At December 31, 2025, this customer owed Hopkins $9,000.

Accounting

Prepare a December 31, 2025, balance sheet for Hopkins Company.

Analysis

Hopkins’ bank is considering granting an additional loan in the amount of $45,000, which will be due December 31, 2026. How can the information in the balance sheet provide useful information to the bank about Hopkins’ ability to repay the loan?

Principles

In the upcoming meeting with the bank, Hopkins plans to provide additional information about the fair value of its equipment and some internally generated intangible assets related to its customer lists. This information indicates that Hopkins has significant unrealized gains on these assets, which are not reflected on the balance sheet. What objections is the bank likely to raise about the usefulness of this information in evaluating Hopkins for the loan renewal?

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield