Electroboy Enterprises, Inc. operates several stores throughout the western United States. As part of an operational and

Question:

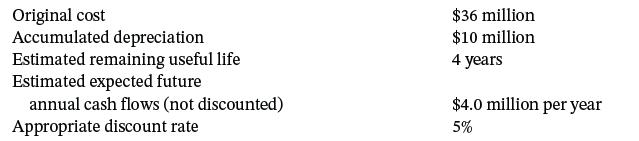

Electroboy Enterprises, Inc. operates several stores throughout the western United States. As part of an operational and financial reporting review in a response to a downturn in its markets, the company’s management has decided to perform an impairment test on five stores (combined). The five stores’ sales have declined due to aging facilities and competition from a rival that opened new stores in the same markets. Management has developed the following information concerning the five stores as of the end of fiscal 2024.

Accounting

a. Determine the amount of impairment loss, if any, that Electroboy should report for fiscal 2024 and the book value at which Electroboy should report the five stores on its fiscal year-end 2024 balance sheet. Assume that the cash flows occur at the end of each year.

b. Repeat part (a), but instead assume that (1) the estimated remaining useful life is 10 years, (2) the estimated annual cash flows are $2,720,000 per year, and (3) the appropriate discount rate is 6%.

AnalysisAssume that you are a financial analyst and you participate in a conference call with Electroboy management in early 2025 (before Electroboy closes the books on fiscal 2024). During the conference call, you learn that management is considering selling the five stores, but the sale won’t likely be completed until the second quarter of fiscal 2025. Briefly discuss what implications this would have for Electroboy’s 2024 financial statements. Assume the same facts as in part (b) above.

PrinciplesElectroboy management would like to know the accounting for the impaired asset in periods subsequent to the impairment. Can the assets be written back up? Briefly discuss the conceptual arguments for this accounting.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield