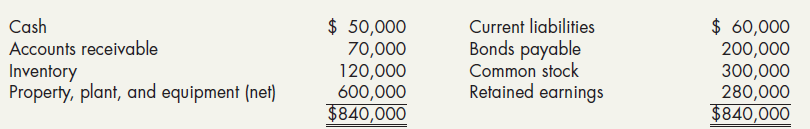

Elm Company is considering purchasing EKC Company. EKCs balance sheet at December 31, 2019, is as follows:

Question:

Elm Company is considering purchasing EKC Company. EKC’s balance sheet at December 31, 2019, is as follows:

At December 31, 2019, Elm discovered the following about EKC:

a. No allowance for uncollectible accounts has been established. An allowance of $5,000 is considered appropriate.

b. The LIFO inventory method has been used. The FIFO inventory method would be used if EKC were purchased by Elm. The FIFO inventory valuation of the December 31, 2019, ending inventory would be $180,000.

c. The fair value of the property, plant, and equipment (net) is $730,000.

d. The company has an unrecorded patent that is worth $120,000.

e. The book values of the current liabilities and bonds payable are the same as their market values.

Required:

1. Compute the value of the goodwill if Elm pays $1,350,000 for EKC.

2. Next Level Why would the book value of a company’s identifiable net assets differ from its market value?

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach