Harrisburg Furniture Company started construction of a combination office and warehouse building for its own use at

Question:

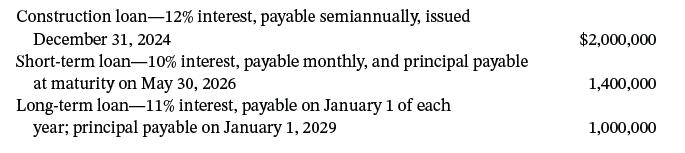

Harrisburg Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $5,000,000 on January 1, 2025. Harrisburg expected to complete the building by December 31, 2025. Harrisburg has the following debt obligations outstanding during the construction period.

Instructions

(Carry all computations to two decimal places.)

a. Assume that Harrisburg completed the office and warehouse building on December 31, 2025, as planned, at a total cost of $5,200,000, and the weighted-average amount of accumulated expenditures was $3,600,000. Compute the avoidable interest on this project.

b. Compute the depreciation expense for the year ended December 31, 2026. Harrisburg elected to depreciate the building on a straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $300,000

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield