Jayryan Company sells products in a volatile market. The company began operating in 2017 and reported (and

Question:

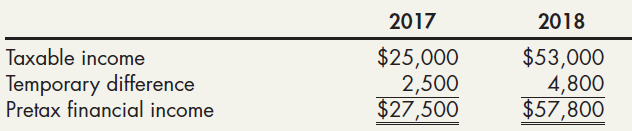

Jayryan Company sells products in a volatile market. The company began operating in 2017 and reported (and paid taxes on) taxable income in 2017 and 2018. It has one taxable temporary difference (future taxable amount) and reconciled its taxable income to its pretax financial income for 2017 and 2018 as follows:

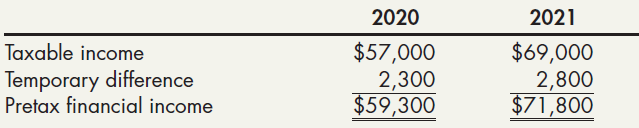

In 2019, because of a downturn in the market, Jayryan reported a taxable loss of $90,000, and it was uncertain as to future profits. A temporary difference of $2,700 resulted in an $87,300 pretax operating loss for financial reporting. In 2020 and 2021, Jayryan was again profitable and reported the following items:

Required:

1. Prepare a schedule that shows Jayryan’s income taxes payable (or receivable) for each year, 2017 through 2021.

2. Prepare a schedule that shows the deferred tax information (change in temporary difference and operating loss carryforward) for each year, 2017 through 2021.

3. Prepare a schedule that shows the deferred taxes for each year, 2017 through 2021.

4. Based on the schedule prepared in Requirement 3, prepare Jayryan’s income tax journal entry at the end of 2019.

5. Prepare a partial income statement for 2019. Include a note for any operating loss carryforward.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach