Kathleen Cole Inc. acquired the following assets in January of 2023. The equipment has been depreciated using

Question:

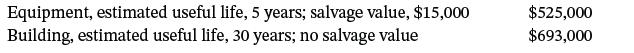

Kathleen Cole Inc. acquired the following assets in January of 2023.

The equipment has been depreciated using the sum-of-the-years’-digits method for the first 3 years for financial reporting purposes. In 2026, the company decided to change the method of computing depreciation to the straight-line method for the equipment, but no change was made in the estimated useful life or salvage value. It was also decided to change the total estimated useful life of the building from 30 years to 40 years, with no change in the estimated salvage value. The building is depreciated on the straight-line method.

Instructions

a. Prepare the general journal entry to record depreciation expense for the equipment in 2026.

b. Prepare the journal entry to record depreciation expense for the building in 2026. (Round all computations to two decimal places.)

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield