Krauss Companys income statement for the year ended December 31, 2025, contained the following condensed information. Krausss

Question:

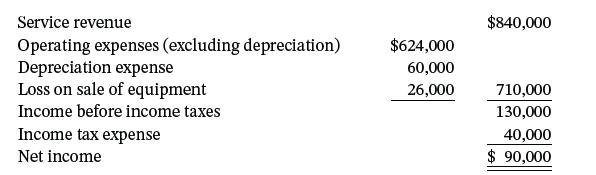

Krauss Company’s income statement for the year ended December 31, 2025, contained the following condensed information.

Krauss’s balance sheet contained the following comparative data at December 31.

(Accounts payable pertains to operating expenses.)

Instructions

Prepare the operating activities section of the statement of cash flows using the direct method.

Transcribed Image Text:

Service revenue Operating expenses (excluding depreciation) Depreciation expense Loss on sale of equipment Income before income taxes Income tax expense Net income $624,000 60,000 26,000 $840,000 710,000 130,000 40,000 $ 90,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 46% (13 reviews)

KRAUSS COMPANY Partial Statement of Cash Flows For the Year Ended December 3...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Krauss Companys income statement for the year ended December 31, 2008, contained the following condensed information. Krausss balance sheet contained the following comparative data at December 31....

-

Data for Krayon Company are presented in E23-5B. In E23-5B, Krayon Companys income statement for the year ended December 31, 2014, contained the following condensed information. Krayons balance sheet...

-

Using the information provided in BE22-15, prepare the operating activities section of the statement of cash flows using the direct method. In BE22-15 Simons Products, Inc. reported the following...

-

A heating section consists of a 10 inch diameter duct which houses a 8 kW electric resistance heater. Air enters the heating section at 14.7 psia, 40oF and 35% relative humidity at a velocity of 21...

-

Amazon.com, Inc., is well known today as an online marketplace for books, music, and other products. Although the increase in its stock price was initially meteoric, it was some years before the...

-

Refer to Exercise 10.9. The data table compares men who viewed high levels of television violence as children with those who did not, in order to study the differences with regard to physical abuse...

-

Use an ANOVA with a 5 .05 to check your prediction. Note: Because the samples are all the same size, MSwithin is the average of the three sample variances. b. Predict how the increase in sample size...

-

The International Air Transport Association surveys business travelers to develop quality ratings for transatlantic gateway airports. The maximum possible rating is 10. Suppose a simple random sample...

-

The Browser Company purchases a computer in August 2020 for $12,000. Browser elects not to claim bonus depreciation and does not elect to expense the asset but wants to claim the maximum...

-

Ashton and Melody Webb are a married couple in their mid-20s. Ashton has a good start as an electrical engineer and Melody works as a sales representative. Since their marriage four years ago, Ashton...

-

Broussard Company reported net income of $3.5 million in 2025. Depreciation for the year was $520,000, accounts receivable increased $500,000, and accounts payable increased $300,000. Compute net...

-

Mortonson Company has not yet prepared a statement of cash flows for the 2025 fiscal year. Comparative balance sheets as of December 31, 2024 and 2025, and a statement of income and retained earnings...

-

Sarbanes-Oxley explicitly addresses the IT security controls required to ensure accurate financial reporting. A. True B. False

-

Describe in your own words how you would expect the data points on a scatterplot to be distributed if the following features were present (i.e. for each part, explain how the feature would look on a...

-

imagine this experimental setup: One temperature probe is in embedded in a small block of frozen sugar water at -20. The frozen sugar water is in a small test tube The melting/freezing point of this...

-

Question 2: (40 points: 10 each) During September, Sweet Foods manufactures a single product. The Company's material purchases amounted to 9,000 pounds at a price of $9.80 per pound. Actual costs...

-

E12-23 (Algo) (Supplement 12B) Preparing a Statement of Cash Flows, Indirect Method: T-Account Approach [LO 12-S2] Golf Goods Incorporated is a regional and online golf equipment retailer. The...

-

A symmetric compound channel in over bank flow has a main channel with a bottom width of 30 m, side slopes of 1:1, and a flow depth of 3m. The floodplains on either side of the main channel are both...

-

The following is an extract from Digital reporting: a progress report, an initiative from the Institute of Chartered Accountants in England & Wales commenting in 2004 on possible barriers to the...

-

For a nonzero constant a, find the intercepts of the graph of (x 2 + y 2 ) 2 = a 2 (x 2 - y 2 ). Then test for symmetry with respect to the x-axis, the y-axis, and the origin.

-

If a company elects the deemed cost exemption, must it continue to use revaluation accounting subsequent to first-time adoption? Explain.

-

Briefly describe the presentation and disclosure requirements for first-time adoption of IFRS.

-

Briefly describe the presentation and disclosure requirements for first-time adoption of IFRS.

-

During the year 2021, William has a job as an accountant, he earns a salary of $100,000. He has done some cleaning services work on his own (self-employed), where he earned a net income of $50,000....

-

Fixed cost per unit is $7 when 25,000 units are produced and $5 when 35,000 units are produced. What is the total fixed cost when 30,000 units are produced? Group of answer choices $150,000....

-

Revenue Recognition and Sales Allowances accounting purposes ) . The goods are shipped from the warehouse on March 6 , and FedEx confirms delivery on March 7 . Ignore shipping costs, sales tax, and...

Study smarter with the SolutionInn App