Kreter Co. provides the following information about its postretirement benefit plan for the year 2025. Instructions Compute

Question:

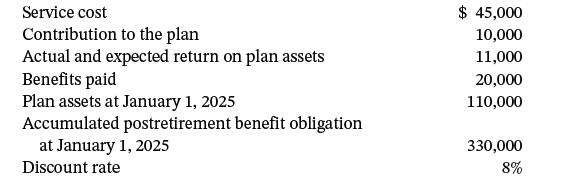

Kreter Co. provides the following information about its postretirement benefit plan for the year 2025.

Instructions

Compute the postretirement benefit expense for 2025.

Transcribed Image Text:

Service cost Contribution to the plan Actual and expected return on plan assets Benefits paid Plan assets at January 1, 2025 Accumulated postretirement benefit obligation at January 1, 2025 Discount rate $ 45,000 10,000 11,000 20,000 110,000 330,000 8%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 87% (8 reviews)

Postretirement benefit expense is compri...View the full answer

Answered By

Nyron Beeput

I am an active educator and professional tutor with substantial experience in Biology and General Science. The past two years I have been tutoring online intensively with high school and college students. I have been teaching for four years and this experience has helped me to hone skills such as patience, dedication and flexibility. I work at the pace of my students and ensure that they understand.

My method of using real life examples that my students can relate to has helped them grasp concepts more readily. I also help students learn how to apply their knowledge and they appreciate that very much.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Kreter Concepts provides the following information about its postretirement benefit plan for the year 2019. Service cost........................................................Russian Rubble 45,000...

-

(Postretirement Benefit Expense Computation) Kreter Co. provides the following information about its postretirement benefit plan for the year 2010. Compute the postretirement benefit expense for...

-

Englehart Co. provides the following information about its postretirement benefit plan for the year 2025. Instructions Compute the postretirement benefit expense for 2025. Service cost Prior service...

-

b) A firm produces two types of sugar, A and B at a constant average cost of RM 2 and RM3 per kilogram, respectively. The quantities, q and qg (in kilogram) of A and B that can be sold each week are...

-

An all-equity firm is considering the projects shown as follows. The T-bill rate is 4 percent and the market risk premium is 7 percent. If the firm uses its current WACC of 12 percent to evaluate...

-

What is the fundamental principle of financial leverage?

-

In what sense do these market value ratios reflect investors opinions about a stocks risk and expected future growth? AppendixLO1

-

North Mark (NM) owns vast amounts of corporate bonds. Suppose that on June 30, 2012, NM buys $800,000 of CitiSide bonds at a price of 102. The CitiSide bonds pay cash interest at the annual rate of...

-

A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $8,000 to start each quarter. Fill in the missing amounts....

-

Define the terms management science and operations research.

-

In a certain suburb of Los Angeles, the level of ozone L(t) at 7:00 A.M. is 0.25 parts per million (ppm). A 12-hour weather forecast predicts that the ozone level t hours later will be changing at...

-

The accounting staff of Usher Inc. has prepared the following pension worksheet. Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in...

-

Below are income statements and balance sheets for the Peyton Company for 2019 and 2018: Required Calculate the following ratios for the Peyton Company for 2019 and 2018 and discuss your findings: 1....

-

The following data apply to Superior Auto Supply Inc. for May 2011. 1. Balance per the bank on May \(31, \$ 8,000\). 2. Deposits in transit not recorded by the bank, \(\$ 975\). 3. Bank error; check...

-

How do you determine whether there is a linear correlation between two variables \(x\) and \(y\) ? Use Table 14.10. Table 14. 10 n a = 0.05 0.950 0.878 4 5 6 0.811 7 0.754 8 0.707 9 0.666 10 0.632 11...

-

Comparative Analysis Problem: Columbia Sportswear Company vs. Under Armour, Inc. The financial statements for the Columbia Sportswear Company can be found in Appendix A and Under Armour, Inc.'s...

-

The following information is available for Book Barn Company's sales on account and accounts receivable: After several collection attempts, Book Barn wrote off \(\$ 4,500\) of accounts that could not...

-

The following information comes from the accounts of Jersey Company: Required a. There were \(\$ 170,000\) of sales on account during the accounting period. Write-offs of uncollectible accounts were...

-

In 2002, the median pH level of the rain in Glacier National Park, Montana, was 5.25. A biologist thinks that the acidity of rain has decreased since then, which would suggest the pH has increased....

-

Why did management adopt the new plan even though it provides a smaller expected number of exposures than the original plan recommended by the original linear programming model?

-

What is the indirect effect of a change in accounting policy? Briefly describe the approach to reporting the indirect effects of a change in accounting policy under IFRS.

-

As part of the year-end accounting process and review of operating policies, Cullen Co. is considering a change in the accounting for its equipment from the straightline method to an accelerated...

-

As part of the year-end accounting process and review of operating policies, Cullen Co. is considering a change in the accounting for its equipment from the straightline method to an accelerated...

-

Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $11,100. He is single and claims 1 deduction. Before this payroll, Barretts cumulative...

-

Bass Accounting Services expects its accountants to work a total of 26,000 direct labor hours per year. The company's estimated total indirect costs are $ 260,000. The company uses direct labor hours...

-

The Balance Sheet has accounts where the accountant must make estimates. Some situations in which estimates affect amounts reported in the balance sheet include: Allowance for doubtful accounts....

Study smarter with the SolutionInn App