Monroe Corporation, a client, requests that you compute the appropriate balance of its estimated liability for product

Question:

Monroe Corporation, a client, requests that you compute the appropriate balance of its estimated liability for product warranty account for a statement as of June 30. 2002.

Monroe Corporation manufactures television components and sells them with a 6-month warranty under which defective components will be replaced without charge.

On December 31, 2001, Estimated Liability for Product Warranty had a balance of \($510,000.\) By June 30, 2002, this balance had been reduced to \($80,250\) by debits for estimated net cost of components returned that had been sold in 2001.

The corporation started out in 2002 expecting 8% of the dollar volume of sales to be returned. However, due to the introduction of new models during the year this estimated percentage of returns was increased to 10% on May 1 . It is assumed that no components sold during a given month are returned in that month. Each component is stamped with a date at time of sale so that the warrant)- may be properly administered.

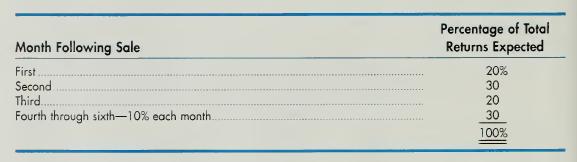

The following table of percentages indicates the likely pattern of sales returns during the 6-month period of the warranty, starting with the month following the sale of components.

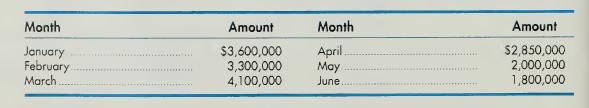

Gross sales of components were as follows for the first 6 months of 2002:

The corporation's warranty also covers the payment of freight cost on defective components returned and on the new components sent out as replacements. This freight cost runs approximately 10% of the sales price of the components returned. The manufacturing cost of the components is roughly 80% of the sales price, and the salvage value of returned components averages 15% of their sales price. Returned components on hand at December 31, 2001, were thus valued in inventory at 15% of their original sales price.

Instructions:

Using the data given, prepare a schedule for arriving at the balance of the estimated liability for product warranty account as ofJune 30, 2002, and give the proposed adjusting entry.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice