On December 31, 2002, the Hadley Company provides the following pre-audit income statement for your review. The

Question:

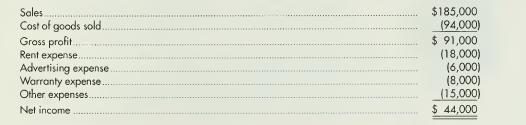

On December 31, 2002, the Hadley Company provides the following pre-audit income statement for your review.

The following information is also available:

(a) Many of Hadley's customers pay for their orders in advance. At year-end, \($18,000\) of orders paid for in advance of shipment have been included in the sales figure.

(b) Hadley introduced and sold several products during the year with a 30-day, moneyback guarantee. During the year, customers seldom returned the products. Hadley has not included in revenue or in cost of goods sold those items sold within the last 30 days that included the guarantee. The revenue is \($16,000\), and the cost associated with the products is \($7,500\).

(c) On January 1, 2002, Hadley prepaid its building rent for 18 months. The entire amount paid, \($18,000\), was charged to Rent Expense.

(d) On July 1, 2002, Hadley paid \($24,000\) for general advertising to be completed prior to the end of 2002. Hadley's management estimates that the advertising will benefit a 2-year period and, therefore, has elected to charge the costs to the income statement at the rate of \($1,000\) a month.

(e) Hadley has collected current cost information relating to its inventory. The cost of goods sold, if valued using current costing techniques, is \($106,000\).

(f) In past years, Hadley has estimated warranty expense using a percentage of sales.

Hadley estimates future warranty costs relating to 2002 sales will amount to 5% of sales. However, during 2002, Hadley elected to charge costs to warranty expense as costs were incurred. Hadley spent \($8,000\) during 2002 to repair and replace defective inventory sold in current and prior periods.

Instructions:

1. For each item of additional information. identify the revenue or expense recognition issue.

2. Prepare a revised income statement using the information provided.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice