On January 1, 2019, Easton Corporation acquired 30% of the outstanding common shares of Feeley Corporation for

Question:

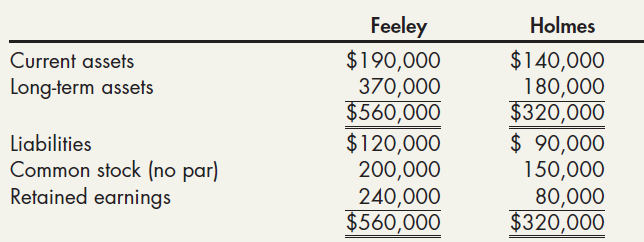

On January 1, 2019, Easton Corporation acquired 30% of the outstanding common shares of Feeley Corporation for $140,000, purchased 25% of the outstanding common shares of Holmes Company for $82,500, and obtained significant influence in both situations. On this date, the financial statements of Feeley and Holmes disclosed the following information:

During 2019, Feeley reported a loss of $70,000 and paid dividends of $40,000; Holmes reported income of $45,000 and paid dividends of $28,000. On January 1, 2020, Easton sold all the Holmes shares for $90,000. Assume Easton records both investments under the equity method and considers that any difference between each purchase price and the respective book value of the net assets acquired is goodwill.

Required:

Prepare journal entries to record (1) the purchase of the Feeley and Holmes shares, (2) the recognition of investment income, (3) the receipt of investee dividends, and (4) the sale of the Holmes shares.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach