On January 2, 2019, Lafayette Machine Shops Inc. signed a 10-year noncancelable lease for a heavyduty drill

Question:

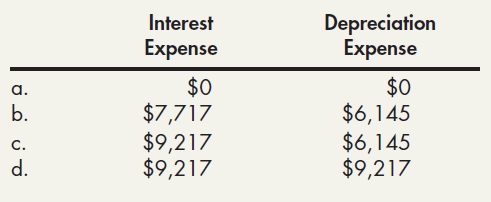

On January 2, 2019, Lafayette Machine Shops Inc. signed a 10-year noncancelable lease for a heavyduty drill press, stipulating annual payments of $15,000 starting at the end of the first year, with title passing to Lafayette at the expiration of the lease. Lafayette treated this transaction as a finance lease. The drill press has an estimated useful life of 15 years with no salvage value. Lafayette uses straight-line depreciation for all of its fixed assets. Aggregate lease payments were determined to have a present value of $92,170, based on implicit interest of 10%. For 2019, Lafayette should record:

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: