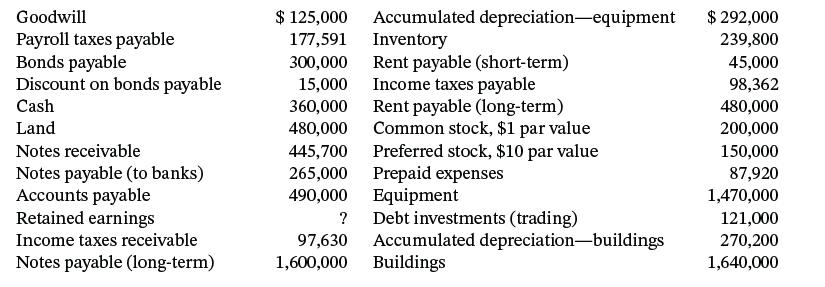

Presented below are a number of balance sheet items for Montoya, Inc. for the current year, 2025.

Question:

Presented below are a number of balance sheet items for Montoya, Inc. for the current year, 2025.

Instructions

Prepare a classified balance sheet in good form. Common stock authorized was 400,000 shares, and preferred stock authorized was 20,000 shares. Assume that notes receivable and notes payable are shortterm, unless stated otherwise. Cost and fair value of debt investments (trading) are the same.

Transcribed Image Text:

Goodwill Payroll taxes payable Bonds payable Discount on bonds payable Cash Land Notes receivable Notes payable (to banks) Accounts payable Retained earnings Income taxes receivable Notes payable (long-term) $ 125,000 177,591 300,000 15,000 360,000 480,000 445,700 265,000 490,000 ? 97,630 1,600,000 Accumulated depreciation-equipment Inventory Rent payable (short-term) Income taxes payable Rent payable (long-term) Common stock, $1 par value Preferred stock, $10 par value Prepaid expenses Equipment Debt investments (trading) Accumulated depreciation-buildings Buildings $ 292,000 239,800 45,000 98,362 480,000 200,000 150,000 87,920 1,470,000 121,000 270,200 1,640,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

Current assets Cash Debtinvestments trading Notes receivable Income taxes receivable Inventory Prepa...View the full answer

Answered By

ARPIT SRIVASTAVA

My Name is ARPIT SRIVASTAVA & I'm From Prayagraj (UTTAR PREDESH). I'm doing Reserch Fron University Of Allahabad. I did my Bachlor's Degree in Physics, Chemistry & Mathematics From University Of Allahabad and I am graduated in 2016. The next Two Year I did my Master's in Chemistry From AU. I have good command in my subject. I want to changing someone's life and giving student opportunity to be productive citizen of the world. I want whatever I know from my subject I answer as better as I can.

0.00

0 Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Presented below are a number of balance sheet items for Letterman, Inc., for the current year, 2008. Instructions Prepare a classified balance sheet in good form. Common stock authorized was 400,000...

-

Presented below are a number of balance sheet items for jay leno, inc., for the current year ended june 30, 2012. debits credits goodwill $ 125,000 payroll taxes payable $ 177,591 bonds payable...

-

Presented below are a number of balance sheet items for Montoya, Inc., for the current year, 2014. Instructions Prepare a classified balance sheet in good form. Common stock authorized was 400,000...

-

1 This question is about the Nature of Programming Languages. a) Explain the essential characteristics and features for each of the following categories of programming language. Provide sample code...

-

Vertigo Company paid $10,000 on July 1, 2009, for a two-year insurance policy. It was recorded as prepaid insurance. Use the accounting equation to show the adjustment Vertigo will make to properly...

-

It has been claimed that 65% of homeowners would prefer to heat with electricity instead of gas. A study finds that 60% of 200 homeowners prefer electric heating to gas. In a two-tail test at the...

-

NEED FOR RENTER'S INSURANCE. lan and Elena Ballard, both graduate students, moved into an apartment near the university. Elena wants to buy renter's insurance, but lan thinks they don't need it...

-

Archer Foods has a freezer that is in need of repair and is considering whether to replace the old freezer with a new freezer or have the old freezer extensively repaired. Information about the two...

-

JoAnne Inc. may buy equipment that is expected to have a 3-year useful life and a $25,000 salvage value. The equipment will cost $1,172,000 and is expected to produce a $69,000 after-tax net income...

-

The Beef-Up Ranch feeds cattle for Midwestern farmers and delivers them to processing plants in Topeka, Kansas, and Tulsa, Oklahoma. The ranch must determine the amounts of cattle feed to buy so that...

-

Presented below is the balance sheet of Sargent Corporation for the current year, 2025. The following information is presented. 1. The current assets section includes cash $150,000, accounts...

-

Harding Corporation has the following accounts included in its December 31, 2025, trial balance: Accounts Receivable $110,000, Inventory $290,000, Allowance for Doubtful Accounts $8,000, Patents...

-

Consider a uniform metal disk rotating 1hrough a perpendicular magnetic field ii, as shown in Fig. 29.19a. The disk has mass m, radius R, and thickness t, is made of a material with resistivity p,...

-

Ranjha Inc. manufactures widgets. The end product is produced in different departments within the plant. One component, C1, is causing some concern. The component is integral to the production of...

-

. Write a Java program in NetBeans that creates a LinkedHashSet. Your Java program must use the methods in the LinkedHashSet interface to do the following: 2.1 Add the above elements into the...

-

on the following statement: Mona is an industrial engineer working for car parts manufacturing facility. She collected the following data on three alternatives of sustainable energy systems to be...

-

Alvarado Company produced 2,900 units of product that required 6 standard direct labor hours per unit. The standard fixed overhead cost per unit is $2.55 per direct labor hour at 16,200 hours, which...

-

Find the complexity of the function given below. void function(int n) { int i, count =0; for(i=1; i*i

-

Kibitz Fitness received $30,000 from customers on August 1, 2019. These payments were advance payments of yearly membership dues. Required: At December 31, 2019, calculate what the balances in the...

-

Prove that the mean heat capacities C P H and C P S are inherently positive, whether T > T 0 or T < T 0 . Explain why they are well defined for T = T 0 .

-

On January 1, 2011, Ryan Animation Ltd., which uses IFRS, sold a truck to Letourneau Finance Corp. for $65,000 and immediately leased it back. The truck was carried on Ryan Animations books at...

-

Lessee Corp. agreed to lease property from Lessor Corp. effective January 1, 2011, for an annual payment of $23,576.90, beginning January 1, 2011. The property is made up of land with a fair value of...

-

Use the information provided in BE2018 about Lessee Corp. Assume that title to the property will not be transferred to Lessee by the end of the lease term and that there is also no bargain purchase...

-

4) Read the following case carefully and answer the given questions. You have been the finance director of a clothing retailer for ten years. The companys year end is 31st December 2019, and you are...

-

all of the other problems here on chegg don't describe right on how they god the answer. can you make it step by step math to show how you got what and from where and each number to get the answer...

-

D Required information The following Information applies to the questions displayed below.) Diego Company manufactures one product that is sold for $76 per unit in two geographic regions-the East and...

Study smarter with the SolutionInn App