Presented below is an amortization schedule related to Spangler Companys 5-year, $100,000 bond with a 7% interest

Question:

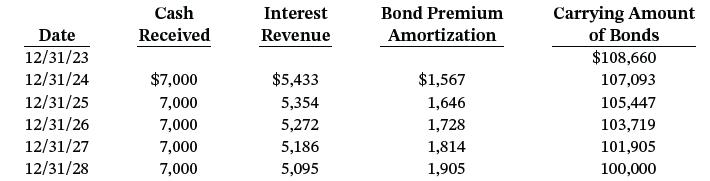

Presented below is an amortization schedule related to Spangler Company’s 5-year, $100,000 bond with a 7% interest rate and a 5% yield, purchased on December 31, 2023, for $108,660.

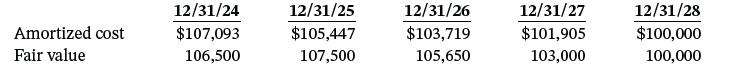

The following schedule presents a comparison of the amortized cost and fair value of the bonds at year-end.

Instructions

a. Prepare the journal entry to record the purchase of these bonds on December 31, 2023, assuming the bonds are classified as held-to-maturity securities.

b. Prepare the journal entry (entries) related to the held-to-maturity bonds for 2024.

c. Prepare the journal entry (entries) related to the held-to-maturity bonds for 2026.

d. Prepare the journal entry (entries) to record the purchase of these bonds, assuming they are classified as available-for-sale.

e. Prepare the journal entry (entries) related to the available-for-sale bonds for 2024.

f. Prepare the journal entry (entries) related to the available-for-sale bonds for 2026.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield