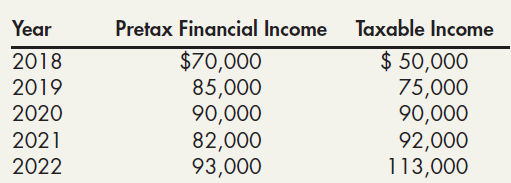

Tanner Corporation begins operations in 2018 and reports the following amounts of pretax financial income and taxable

Question:

Tanner Corporation begins operations in 2018 and reports the following amounts of pretax financial income and taxable income for the years 2018 through 2022. Tanner has only one temporary difference and only one originating or reversing difference occurs in any single year. Tanner is subject to a tax rate of 30% for all the years.

Required:

1. Prepare the income tax journal entry for each year.

2. Next Level What do you notice about the balance in the deferred taxes over the 5 years?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: