The following are selected ledger accounts of Spock Corporation at December 31, 2025. Spocks effective tax rate

Question:

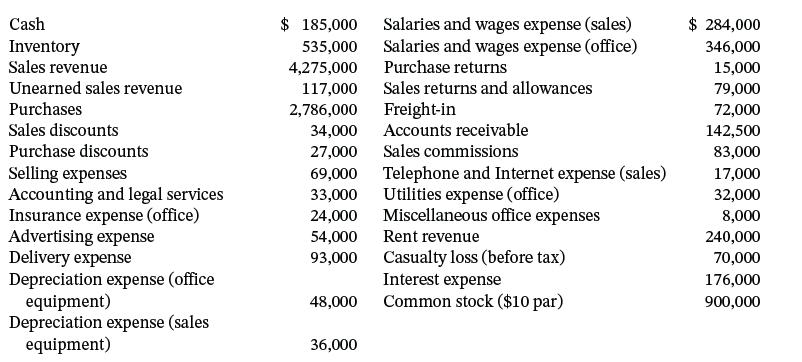

The following are selected ledger accounts of Spock Corporation at December 31, 2025.

Spock’s effective tax rate on all items is 20%. A physical inventory indicates that the ending inventory is $686,000.

Instructions

Prepare a condensed 2025 multi-step income statement for Spock Corporation.

Transcribed Image Text:

Cash Inventory Sales revenue Unearned sales revenue Purchases Sales discounts Purchase discounts Selling expenses Accounting and legal services Insurance expense (office) Advertising expense Delivery expense Depreciation expense (office equipment) Depreciation expense (sales equipment) $ 185,000 535,000 4,275,000 117,000 2,786,000 34,000 27,000 69,000 33,000 24,000 54,000 93,000 48,000 36,000 Salaries and wages expense (sales) Salaries and wages expense (office) Purchase returns Sales returns and allowances Freight-in Accounts receivable Sales commissions Telephone and Internet expense (sales) Utilities expense (office) Miscellaneous office expenses Rent revenue Casualty loss (before tax) Interest expense Common stock ($10 par) $ 284,000 346,000 15,000 79,000 72,000 142,500 83,000 17,000 32,000 8,000 240,000 70,000 176,000 900,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

SPOCK CORPORATION Income Statement For the Year Ended December 31 2025 Net s...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

The following are selected ledger accounts of Spock Corporation at December 31, 2014. Spocks effective tax rate on all items is 34%. A physical inventory indicates that the ending inventory is...

-

Condensed Income StatementPeriodic Inventory Method Presented below are selected ledger accounts of Woods Corporation at December 31, 2010. Woodss effective tax rate on all items is 30%. A physical...

-

XYZ SAOG has issued 5 million equity shares OMR 1 per share. The company decided to make a bonus issue in the ratio of 2 for 5 shares held. What is the amount of bonus (OMR) should be created by the...

-

1. Jowel, the financial manager for Berjayasama Bhd, wishes to evaluate three potential investments: Investment A, Investments B and Investment C. Table 1 shows the expected returns. You have been...

-

R.K. Boats Inc. is in the process of making some major investments for growth and is interested in calculating their cost of equity so as to be able to correctly estimate their adjusted WACC. The...

-

Find the lowest common multiple of the following numbers: a. 6, 14 b. 4, 15 c. 2, 7, 10 d. 3, 9, 10 e. 3, 7, 11

-

Pick goods. Items required from stock must be selected from storage and brought to a marshalling area. LO.1

-

Summarized versions of Calabasa Corporations financial statements for two recent years are as follows. Requirement 1. Complete Calabasa Corporations financial statements by determining the missing...

-

If markets are efficient, the expected return on all investments is identical. O True. False

-

The stockholders equity section of Hendly Corporation appears below as of December 31, 2025. Net income for 2025 reflects a total effective tax rate of 20%. Included in the net income figure is a...

-

Eddie Zambrano Corporation began operations on January 1, 2022. During its first 3 years of operations, Zambrano reported net income and declared dividends as follows. The following information...

-

In Exercises 714, use the Power Rule to compute the derivative. 1P P

-

As a new principal, I assigned a teacher to a different grade for the coming year. I did not expect to cause the anxiety it did. The teacher first came to me in tears and begged for her assignment to...

-

Peruse the following websites to learn about the different ways of categorizing leadership. 1. https://www.businessnewsdaily.com/9789-leadership-types.html 2....

-

Making Consumer Choices The Espresso Machine (25 points) In real life, you must often make choices about whether to buy something pre-made or make it yourself. There are many things to consider:...

-

1) Read over the article/case and summarize what it is referring to in your own words. 2) What type of leadership traits can you describe in the case study? Use materials both from the handout and...

-

After reading or watching, https://smallbusiness.chron.com/internal-analysis-important-80513.html https://www.indeed.com/career-advice/career-development/internal-analysis...

-

How do you feel about companies looking for ways to avoid coverage under the Affordable Care Act? b- Small Compared to Large Companies. Is it more understandable that small companies like these would...

-

Determine the values of the given trigonometric functions directly on a calculator. The angles are approximate. tan 0.8035

-

Use the information in BE21-1, but assume instead that the change to the straight-line method was made because straight-line better represents the pattern of benefits provided by the capital assets....

-

Bailey Corp. changed depreciation methods in 2011 from straight-line to double-declining-balance because management argued that the change would improve the relevance of the information to financial...

-

Bronson, Inc. changed from the average cost formula to the FIFO cost formula in 2011. The increase in the prior years income before taxes as a result of this change is $435,000. The tax rate is 35%....

-

The star Mira is 1.2 times the mass of the Sun and about 10,000 times more luminous than the Sun. Would Mira fit into the table above? Why or why not?

-

Which of the following was one of the most valuable benefits a company received as a sponsor of NHL games?

-

Cinder Inc. is a Canadian-controlled private corporation based in your province. The company operates a wholesale business. The following information is provided for its year ended May 31, 2023: Net...

Study smarter with the SolutionInn App