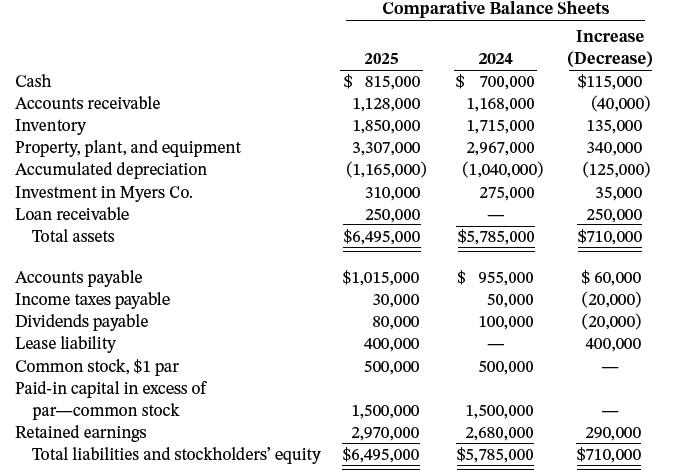

The following are Sullivan Corp.s comparative balance sheet accounts at December 31, 2025 and 2024, with a

Question:

The following are Sullivan Corp.’s comparative balance sheet accounts at December 31, 2025 and 2024, with a column showing the increase (decrease) from 2024 to 2025.

Additional information:

1. On December 31, 2024, Sullivan acquired 25% of Myers Co.’s common stock for $275,000. On that date, the carrying value of Myers’s assets and liabilities, which approximated their fair values, was $1,100,000. Myers reported income of $140,000 for the year ended December 31, 2025. No dividend was paid on Myers’s common stock during the year.

2. During 2025, Sullivan loaned $300,000 to TLC Co., an unrelated company. TLC made the first semiannual principal repayment of $50,000, plus interest at 10%, on December 31, 2025.

3. On January 2, 2025, Sullivan sold equipment costing $60,000, with a carrying amount of $38,000, for $40,000 cash.

4. On December 31, 2025, Sullivan entered into a capital lease for an office building. The present value of the annual rental payments is $400,000, which equals the fair value of the building. Sullivan made the first rental payment of $60,000 when due on January 2, 2026.

5. Net income for 2025 was $370,000.

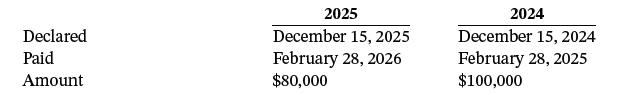

6. Sullivan declared and paid the following cash dividends for 2025 and 2024.

Instructions

Prepare a statement of cash flows for Sullivan Corp. for the year ended December 31, 2025, using the indirect method.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield