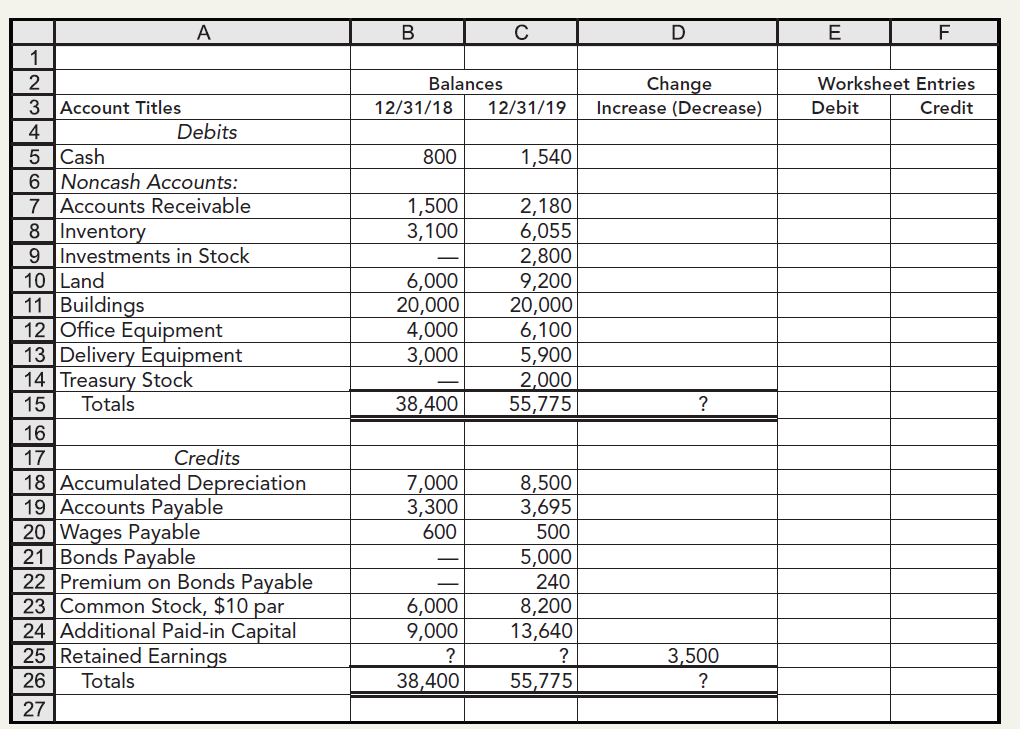

The following partially completed spreadsheet has been prepared for Perrin Companys 2019 statement of cash flows: Additional

Question:

The following partially completed spreadsheet has been prepared for Perrin Company’s 2019 statement of cash flows:

Additional relevant information:

a.

b. Accumulated depreciation is a contra account for all the depreciable assets. Depreciation on these assets totaled $2,200 for the year.

c. On January 1, 2019, the company issued 10% bonds with a face value of $5,000 at 106. Interest was paid semiannually on June 30 and December 31. The bonds mature on January 1, 2024. Straight-line amortization is used for bond discount or premium. Bond interest expense was $440.

d. Land was purchased for $3,200 during the year.

e. Two hundred shares of common stock were issued for delivery equipment valued at $2,900 and office equipment valued at $3,100.

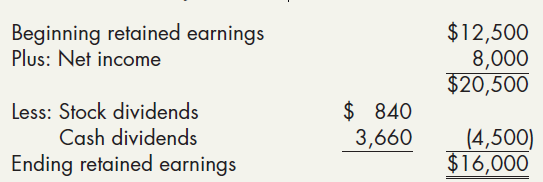

f. Twenty shares of stock were issued as a stock dividend. The market price per share was $42.

g. Office equipment with a cost of $1,000 and a book value of $300 was sold for $50.

h. Fifty shares of its own common stock were reacquired by the company as treasury stock. The company purchased the shares for $40 per share.

i. One hundred shares of Doe Company stock were purchased for $28 per share at year-end.

Required:

Complete the spreadsheet.

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach