The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all

Question:

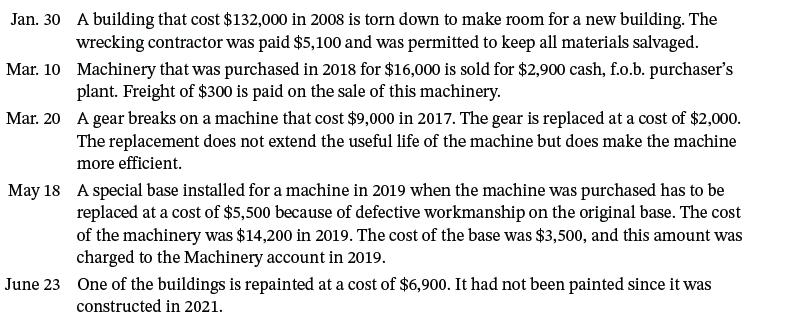

The following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all fixed assets acquired during the year, and no depreciation is charged on fixed assets disposed of during the year.

Instructions

Prepare general journal entries for the transactions. (Round to the nearest dollar.)

Jan. 30 Mar. 10 Mar. 20 A building that cost $132,000 in 2008 is torn down to make room for a new building. The wrecking contractor was paid $5,100 and was permitted to keep all materials salvaged. Machinery that was purchased in 2018 for $16,000 is sold for $2,900 cash, f.o.b. purchaser's plant. Freight of $300 is paid on the sale of this machinery. A gear breaks on a machine that cost $9,000 in 2017. The gear is replaced at a cost of $2,000. The replacement does not extend the useful life of the machine but does make the machine more efficient. May 18 A special base installed for a machine in 2019 when the machine was purchased has to be replaced at a cost of $5,500 because of defective workmanship on the original base. The cost of the machinery was $14,200 in 2019. The cost of the base was $3,500, and this amount was charged to the Machinery account in 2019. June 23 One of the buildings is repainted at a cost of $6,900. It had not been painted since it was constructed in 2021.

Step by Step Answer:

130 Accumulated Depreciation Buildings Loss on Disposal o...View the full answer

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

The following transactions occurred during 2017. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated...

-

The following transactions occurred during 2014. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated...

-

The following transactions occurred during 2012. Assume that depreciation of 10% per year is charged on all machinery and 3% per year on buildings, on a straight-line basis, with no estimated salvage...

-

1) The mast on the boat is held in place by the rigging, which consists of rope having a diameter of 25 mm and a total length of 50m. Assuming the rope to be cylindrical, determine the drag it exerts...

-

Rewrite the following sentences, making them shorter and more concise while maintaining their main points: a. For good reasons, the secretary may grant extensions of time in 30-day increments for...

-

The production engineers at Impact Industries have derived the expansion path shown in the following figure. The price of labor is $100 per unit. a. What price does Impact Industries pay for capital?...

-

What Are Common Barriers to Effective Communication? (pp. 120124)

-

The Arnold Palmer Hospital (APH) in Orlando, Florida, is one of the busiest and most respected hospitals for the medical treatment of children and women in the U.S. Since its opening on golfing...

-

Trinkle Company, Incorporated made several purchases of long-term assets in Year 1. The details of each purchase are presented here. New Office Equipment List price: $38,100; terms: 2/10 n/30; paid...

-

Kelly Clarkson Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2025. The terms of acquisition for each truck...

-

Worf Co. both purchases and constructs various equipment it uses in its operations. The following items for two different types of equipment were recorded in random order during the calendar year...

-

Octane (C8H18) is burned with theoretical amount of air at a pressure of 500 kPa. Determine (a) The air fuel ratio on a mole basis. (b) The air fuel ratio on a mass basis. (c) If the products are...

-

Turn this information into an excel sheets with the excel formulas being shown P10.1 (LO 1) (Depreciation for Partial Period-SL, SYD, and DDB) Alladin Company purchased Machine #201 on May 1, 2025....

-

You are the Financial Analyst at Wellington Laboratories Ltd., a New Orleans, USA based bulk drugs manufacturer, which is evaluating the following project for manufacturing a new compound. Year Cash...

-

A variable mesh screen produces a linear and axisymmetric velocity profile as indicated below in the air flow through a 2-ft diameter circular cross section duct. The static pressures upstream and...

-

A vertical round steel rod 2 m long is securely held at its upper end. A weight can slide freely on the rod and its fall is arrested by a stop provided at the lower end of the rod. When the weight...

-

8) Determine the magnitudes of the forces F and P so that the single equivalent couple (i.e. the resultant of the three couples) acting on the triangular block is zero. Z -F F 3 m 10 N, 30 6 m 10 N 3...

-

Discuss the extent to which the regulatory bodies explained in this chapter have, or ought to have, a particular concern for the needs of the following groups of users of financial statements: (a)...

-

What is the mode?

-

Springsteen Co. had the following activity in its most recent year of operations. (a) Pension expense exceeds amount funded. (b) Redemption of bonds payable. (c) Sale of building at book value. (d)...

-

Data for Fairchild Company are presented in E23-11. Prepare a statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.)

-

Brockman Guitar Company is in the business of manufacturing top-quality, steel-string folk guitars. In recent years the company has experienced working capital problems resulting from the procurement...

-

Calculate Social Security taxes, Medicare taxes and FIT for Jordon Barrett. He earns a monthly salary of $11,100. He is single and claims 1 deduction. Before this payroll, Barretts cumulative...

-

Bass Accounting Services expects its accountants to work a total of 26,000 direct labor hours per year. The company's estimated total indirect costs are $ 260,000. The company uses direct labor hours...

-

The Balance Sheet has accounts where the accountant must make estimates. Some situations in which estimates affect amounts reported in the balance sheet include: Allowance for doubtful accounts....

Study smarter with the SolutionInn App