The Wasatch Construction Company entered into a ($4,500,000) contract in early 2002 to construct a multipurpose recreational

Question:

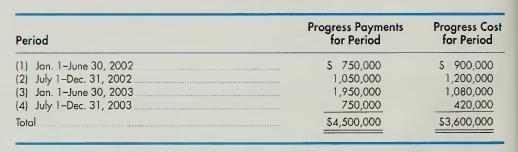

The Wasatch Construction Company entered into a \($4,500,000\) contract in early 2002 to construct a multipurpose recreational facility for the city of helper. Construction time extended over a 2-year period. The table below describes the pattern of progress payments made by the city of Helper and costs incurred by Wasatch Construction by semiannual periods. Estimated costs of S3.600,000 were incurred as expected.

The Wasatch Construction Company prepares financial statements twice each year.

June 30 and December 31.

Instructions:

1. Based on the foregoing data, compute the amount of revenue, costs, and gross profit for the four semiannual periods under each of the following methods of revenue recognition.

(a) Percentage of completion

(b) Completed contract

(c) Installment sales (gross profit only)

(d) Cost recovery (gross profit only)

2. Which method do you feel best measures the performance of Wasatch on this contract?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice