Veldre Company provides the following information about its defined benefit pension plan for the year 2025. Instructions

Question:

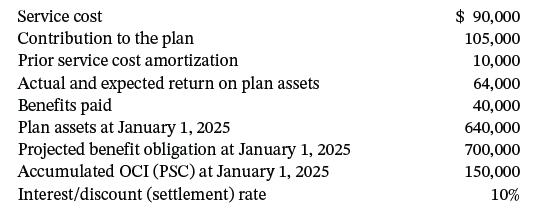

Veldre Company provides the following information about its defined benefit pension plan for the year 2025.

Instructions

Compute the pension expense for the year 2025.

Transcribed Image Text:

Service cost Contribution to the plan Prior service cost amortization Actual and expected return on plan assets Benefits paid Plan assets at January 1, 2025 Projected benefit obligation at January 1, 2025 Accumulated OCI (PSC) at January 1, 2025 Interest/discount (settlement) rate $ 90,000 105,000 10,000 64,000 40,000 640,000 700,000 150,000 10%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Computation of pension expense Servic...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Veldre SpA provides the following information about its defined benefit pension plan for the year 2019. Service cost........................................................... 90,000 Contribution to...

-

Kingbird Company provides the following information about its defined benefit pension plan for the year 2017. Service cost $90,600 Contribution to the plan 103,900 Prior service cost amortization...

-

Rebekah Company provides the following information about its defined benefit pension plan for the year 2010. Service cost........................................................................... ...

-

When developing cost functions, which of the following statements is FALSE? A. Personal observations of costs and activities provide the best evidence of a plausible relationship between a cost and...

-

Why is the payroll system of most entities computerized?

-

The probability of a randomly selected car crashing during a year is 0.0423 (based on data from the Statistical Abstract of the United States). If a family has three cars, find the probability that...

-

Phoenix Hotels and Clubs had the following transactions during the current period. LO5 Mar. 2 Issued 5,000 shares of $1 par value common stock to attorneys in payment of a bill for $27,000 for...

-

(Postretirement Benefit WorksheetMissing Amounts) The accounting staff of Holder Inc. has prepared the postretirement benefit worksheet on page 1102. Unfortunately, several entries in the worksheet...

-

Problem 8-5 (Part Level Submission) Some of the information found on a detail inventory card for Headland Inc. for the first month of operations is as follows. Received No. of Units Unit Cost 1,600...

-

British-based SuperGroup, owner of Superdry and its carefully banded product lines, is taking actions to deal with recent performance problems. These problems manifested themselves in various ways,...

-

Wangerin Company reported the following pretax financial income (loss) for the years 2023 2027. Pretax financial income (loss) and taxable income (loss) were the same for all years involved. The...

-

Campbell Soup Company reported pension expense of $73 million and contributed $71 million to the pension fund. Prepare Campbells journal entry to record pension expense and funding, assuming campbell...

-

Compute the mean and variance of the following discrete probability distribution. x P(x) 2................................. .5 8................................. .3 10..................................

-

Please help. I would really appreciate it. Question 1. Polly owns an electric power plant in the city of Newtown. The market price of electricity in Newtown is $1.00 per kilowatt hour (kwh). Polly's...

-

(Appendix 3A) Jenson Manufacturing is developing cost formula for future planning and cost control. Utilities is one of the mixed costs associated with production. The cost analyst has suggested that...

-

A company has the following trial balance as at 31 December 2015: TRIAL BALANCE AS AT 31 DEC 2015 Dr Cr Sales Revenue 125 000 Purchases 78 000 Carriage 4 000 Electricity and rent 5 100 Administrative...

-

What gets printed to the screen by the following segment of code? String str1 = "hello"; String str2 = "world"; if (!strl.equals(str2)) { System.out.println(str1+" "+str2); } else { }...

-

a) Consider the following financial data (in millions of dollars) for Costello Laboratories over the period of 2014-2018: Year Sales Net income Total assets Common equity 2014 $3,800 $500 $3,900...

-

Determine the level of measurement of each variable. 1. Birth year 2. Marital status 3. Stock rating (strong buy, buy, hold, sell, strong sell) 4. Number of siblings

-

You are a Loan Officer with an Investment Bank. Today you need to set your lending parameters. They are: LTV: 55% 10 Year T-Bill: TBD Rate Markup: 300 Basis Points Term: 30 Years Amortization: 30...

-

Mary Tokar is comparing a U.S. GAAP -based company to a company that uses IFRS. Both companies report non-trading equity investments. The IFRS company reports unrealized losses on these investments...

-

Wang Corp. had $100,000 of 7%, $20 par value preference shares and 12,000 shares of $25 par value ordinary shares outstanding throughout 2011. (a) Assuming that total dividends declared in 2011 were...

-

On February 1, 2010, Gruber Corporation issued 3,000 shares of its 5 par value ordinary shares for land worth 31,000. Prepare the February 1, 2010, journal entry.

-

Mass LLp developed software that helps farmers to plow their fiels in a mannyue sthat precvents erosion and maimizes the effoctiveness of irrigation. Suny dale paid a licesnsing fee of $23000 for a...

-

Average Rate of Return The following data are accumulated by Lone Peak Inc. in evaluating two competing capital investment proposals: 3D Printer Truck Amount of investment $40,000 $50,000 Useful life...

-

4. (10 points) Valuation using Income Approach An appraiser appraises a food court and lounge and provides the following assessment: o O The building consists of 2 floors with the following (6)...

Study smarter with the SolutionInn App