Youngman Corporation has temporary differences at December 31, 2025, that result in the following deferred taxes. Indicate

Question:

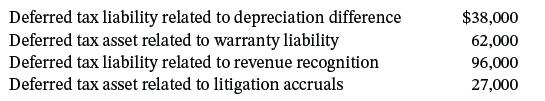

Youngman Corporation has temporary differences at December 31, 2025, that result in the following deferred taxes.

Indicate how these balances would be presented in Youngman’s December 31, 2025, balance sheet.

Transcribed Image Text:

Deferred tax liability related to depreciation difference Deferred tax asset related to warranty liability Deferred tax liability related to revenue recognition Deferred tax asset related to litigation accruals $38,000 62,000 96,000 27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

The net deferred tax liability of 45000 sh...View the full answer

Answered By

Rohail Amjad

Experienced Finance Guru have a full grip on various sectors, i.e Media, Insurance, Automobile, Rice and other Financial Services.

Have also served in Business Development Department as a Data Anlayst

4.70+

32+ Reviews

83+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Youngman Ltd. has temporary differences at December 31, 2019, that result in the following deferred taxes. Deferred tax asset................................HK$24,000 Deferred tax...

-

Youngman Corporation has temporary differences at December 31, 2012, that result in the following deferred taxes. Deferred tax asset .... $24,000 Deferred tax liability .. $69,000 Indicate how these...

-

Youngman Corporation has temporary differences at December 31, 2022, that result in the following deferred taxes. All of these items are associated with the same taxing authority. Deferred tax...

-

Two positive charges, each with charge q = 2.5 nC, are placed as shown in the diagram. The distance d 0.42 m. Find the net electric potential at the point x = 0, y = 0.12 m.

-

Identify three possible disclosure issues for payroll expense and payroll-related liabilities.

-

Listed below are the amounts (million metric tons) of carbon monoxide emissions in the United States for each year of a recent ten-year period. The data are listed in order. Construct the graph that...

-

Rebecca entered into a written contract to sell certain real estate to Mary, a minor, for $80,000, payable $4,000 on the execution of the contract and $800 on the first day of each month thereafter...

-

Using the information in Section 7.4, Training Programs for the Acquisition of Required Skills, create a presentation with 15-25 slides that communicate (i) a brief explanation of the nature of your...

-

Zahn Inc. sold 16,500 annual magazine subscriptions for $50 during December 20Y4. These new subscribers will receive monthly issues, beginning in January 20Y5. Zahn Inc. issued a $130,000, 180day, 5%...

-

A square loop, side a, resistance R, lies a distance s from an infinite straight wire that carries current I (Fig. 7.28). Now someone cuts the wire, so that I drops to zero. In what direction does...

-

During 2025, Kate Holmes Co.s first year of operations, the company reports pretax financial income at $250,000. Holmess enacted tax rate is 45% for 2025 and 20% for all later years. Holmes expects...

-

Novotna Inc.s only temporary difference at the beginning and end of 2024 is caused by a $3 million deferred gain for tax purposes for an installment sale of a plant asset, and the related receivable...

-

As CFO for Everything.Com, you are shopping for 5,000 square feet of usable office space for 25 of your employees in Center City, USA. A leasing broker shows you space in Apex Atrium, a 10-story...

-

Global Operations Management is supported by Strategic Supply Chain Management in many ways. Elucidate the following; List and briefly define/describe the Five (5) Components of Strategic Supply...

-

The Alpine House, Inc. is a large winter sports equipment broker. Below is an income statement for the company's ski department for a recent quarter. LA CASA ALPINA, INC. Income Statement - Ski...

-

Two investment portfolios are shown. Investment Portfolio 1 Portfolio 2 ROR Savings Account $1,425 $4,500 2.80% Government Bond $1,380 $3,600 1.55% Preferred Stock $3,400 $2,150 11.70% Common Stock...

-

The following information pertains to JAE Corporation at January 1, Year 1: Common stock, $8 par, 11,000 shares authorized, 2,200 shares issued and outstanding Paid-in capital in excess of par,...

-

Group dynamics are important elements within the leading facet of the P-O-L-C framework. Discuss a time in your professional, school, or personal life when you experienced the Five Stages of Group...

-

The frequency histogram represents the number of alcohol-related traffic fatalities by state (including Washington, D.C.) in 2012 according to Mothers Against Drunk Driving. (a) Determine the class...

-

Find the radius of convergence of? 1.2.3 1.3.5 (2n-1) r2n+1 -1

-

What is goodwill? What is a bargain purchase?

-

What is net interest? Identify the elements of net interest and explain how they are computed.

-

Bill Haley is learning about pension accounting. He is convinced that in years when companies record liability gains and losses, total comprehensive income will not be affected. Is Bill correct?...

-

Duncan Inc. issued 500, $1,200, 8%, 25 year bonds on January 1, 2020, at 102. Interest is payable on January 1. Duncan uses straight-line amortization for bond discounts or premiums. INSTRUCTIONS:...

-

WISE-HOLLAND CORPORATION On June 15, 2013, Marianne Wise and Dory Holland came to your office for an initial meeting. The primary purpose of the meeting was to discuss Wise-Holland Corporation's tax...

-

Stock in ABC has a beta of 0.9. The market risk premium is 8%, and T-bills are currently yielding 5%. The company's most recent dividend is $1.60 per share, and dividends are expected to grow at a 6%...

Study smarter with the SolutionInn App