Accounts receivable for Smith Ltd. were reported on the statement of financial position prepared at the end

Question:

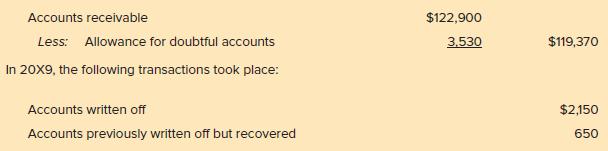

Accounts receivable for Smith Ltd. were reported on the statement of financial position prepared at the end of 20X8, as follows:

Additional information:

The company sells goods on account. At the end of the year, accounts receivable are aged and the following percentages are applied in arriving at an estimate of the charge for doubtful accounts.

Estimated loss

Current accounts ............................................................. 0%

Accounts 1–2 months overdue ..................................... 7%

Accounts 3–6 months overdue ..................................... 20%

Accounts 7–12 months overdue ..................................... 50%

Accounts more than 1 year overdue .............................. 95%

At the end of the year, most of the accounts receivable are current. However, the aging schedule (after write offs and recoveries) shows the following:

Accounts 1–2 months overdue ..................................... $7,500

Accounts 3–6 months overdue ..................................... 6,100

Accounts 7–12 months overdue ................................... 2,500

Accounts more than 1 year overdue.............................. 880

Required:

1. Give the entries required to record the transactions listed above and also to adjust the accounts.

2. Calculate the balance for accounts receivable and the related allowances as at 31 December 20X9, and show these accounts as they will appear on the statement of financial position.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick