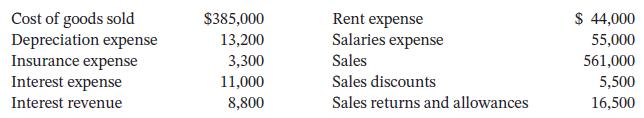

Chocolate Treats has the following account balances: Assuming Chocolate Treats uses a multiple-step income statement, calculate the

Question:

Chocolate Treats has the following account balances:

Assuming Chocolate Treats uses a multiple-step income statement, calculate the following:

(a) Net sales,

(b) Gross profit,

(c) Operating expenses,

(d) Profit from operations,

(e) Profit.

Transcribed Image Text:

Cost of goods sold Depreciation expense Insurance expense Interest expense Interest revenue $385,000 13,200 3,300 11,000 8,800 Rent expense Salaries expense Sales Sales discounts Sales returns and allowances $ 44,000 55,000 561,000 5,500 16,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 44% (9 reviews)

a Net sales 539000 561000 5500 16500 b Gross ...View the full answer

Answered By

Anurag Agrawal

I am a highly enthusiastic person who likes to explain concepts in simplified language. Be it in my job role as a manager of 4 people or when I used to take classes for specially able kids at our university. I did this continuously for 3 years and my god, that was so fulfilling. Sometimes I've skipped my own classes just to teach these kids and help them get their fair share of opportunities, which they would have missed out on. This was the key driver for me during that time. But since I've joined my job I wasn't able to make time for my passion of teaching due to hectic schedules. But now I've made a commitment to teach for at least an hour a day.

I am highly proficient in school level math and science and reasonably good for college level. In addition to this I am especially interested in courses related to finance and economics. In quest to learn I recently gave the CFA level 1 in Dec 19, hopefully I'll clear it. Finger's crossed :)

4.80+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

At which of the lettered positions would an observer be able to see the image of the dot in the mirror? A B D E

-

Chocolate Treats has the following account balances: Cost of goods sold..........$385,000.....................Rent expense................$ 44,000 Depreciation...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

explain the term " system development" and describe the steps involved in system development

-

The following information is from the comparative balance sheets of Runnels Cosmetics Company at March 31, 2010 and 2009: Net income for the year ended March 31, 2010, was $157,000. Depreciation...

-

A fighter jet flies at a speed of Mach 1.5. (a) If the jet were to fly faster than Mach 1.5, the half-angle of the conical shock wave would (1) increase, (2) remain the same, (3) decrease. Why? (b)...

-

3. Workers assembling the tables are supervised by a factory supervisor who is paid $45,000 per year.

-

Gatlin Company issued $300,000, 8%, 15-year bonds on December 31, 2011, for $288,000. Interest is payable annually on December 31. Gatlin uses the straight-line method to amortize bond premium or...

-

10 KL. Company UNADJUSTED TRIAL BALANCE March 31, 2018 ACCOUNT TITLE CREDIT DEBIT 10,950.00 2 Accounts Receivable 1,900.00 Suppties Equipment 17,500.00 Accounts Payable 300.00 6 Notes Payable...

-

Jay Gatsby categorizes wines into one of three clusters. The centroids of these clusters, describing the average characteristics of a wine in each cluster, are listed in the following table. Jay has...

-

Raymond is the accountant at an electronics retail store. He is friends with one of the salespeople, Geoff. The electronics retail store follows ASPE. Geoff tells Raymond to simply debit Sales...

-

The following is an alphabetical list of Tses Tater Tots adjusted account balances at the end of the companys fiscal year on December 31, 2024: Additional information: 1. Tses Tater Tots uses a...

-

What industry/competition opportunities and threats do you see in this case? lo1

-

When in 1920 the Chia brothers opened their first shop in Bangkok selling seeds for farmers, they did not know that they were on the way to launching the development of one of the most successful...

-

In Exercises 49-52, sketch a plane. Then sketch the described situation. Three noncollinear points that lie in the plane

-

In Exercises 49-52, sketch a plane. Then sketch the described situation. A plane perpendicular to the given plane

-

Trace the polygon and point P on paper. Then draw a rotation of the polygon the given number of degrees about P. 150 F P G

-

Trace the polygon and point P on paper. Then draw a rotation of the polygon the given number of degrees about P. 30 B C

-

At the beginning of the year, McCoy Company bought three used machines from Colt, Inc. The machines immediately were overhauled, installed, and started operating. Because the machines were different,...

-

Select a mass spectrometric technique with the highest mass resolution for identifying an unknown compound being eluted from a liquid chromatography column

-

South Hampton Pool Supplies' May 31, 2017, bank balance was $7,350. The company's cash balance at May 31 was $8,210. Other information follows: 1. Outstanding cheques were #321 for $653, #371 for...

-

Sunil's Supplies has hired a new junior accountant and has given her the task of identifying what should be reported as cash as at February 28, 2017, on the company's balance sheet. The following...

-

Cheema Company maintains a petty cash fund for small expenditures. The following transactions occurred over a two-month period: July 1 Established petty cash fund by writing a cheque on Haida Bank...

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App