GS Retail reported the following for the past two fiscal years: (a) Calculate the gross profit margin

Question:

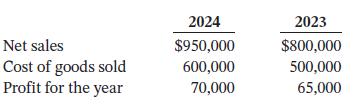

GS Retail reported the following for the past two fiscal years:

(a) Calculate the gross profit margin and profit margin for both years.

(b) Comment on any changes in profitability.

Transcribed Image Text:

Net sales Cost of goods sold Profit for the year 2024 $950,000 600,000 70,000 2023 $800,000 500,000 65,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (5 reviews)

2024 Gross profit margin 3684 950000 600000 950000 Profit marg...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Students also viewed these Business questions

-

dN What are the steady states of dt = -a +bN ? Are they stable or unstable and why?

-

Gabalon Retail reported the following for the past two fiscal years: _______________________________20142013 Net sales..............................$950,000.........$800,000 Cost of goods...

-

GS Retail reported the following for the past two fiscal years: _____________________________ 2017___________2016 Net sales.....$950,000.600,000 Cost of goods sold...600000...500000...

-

Products are 1. Lip gloss or lipstick with SPF 2. Custom facial sheets you can make online or in store pickup and have it send to your home based on your needs 3. A foundation sunscreen Price Provide...

-

To prepare its statement of cash flows for the year ended December 31, 2012, N.C. Lewis Technology International, Inc., gathered the following information: Dividends declared ............. $ 25,000...

-

The intensity levels of two people holding a conversation are 60 dB and 70 dB, respectively. What is the intensity of the combined sounds?

-

Consumers and attorney generals in more than 40 states accused a prominent nationwide chain of auto repair shops of misleading customers and selling them unnecessary parts and services, from brake...

-

High low, break even. Lancer audio produces a high-end DVD player that sells for 1250. Total operating expenses for the past 12 months are as follows: Required: a. Use the high-low method to...

-

Question 5: You have a choice of accepting either of two 5-year cash flow streams or single amounts. One cash flow stream is an ordinary annuity, and the other is a mixed stream. You may accept...

-

When one hears the word entrepreneur, many faces come to mind. Elon Musk, Sara Blakely, Warren Buffet, Martha Stewart, Bill Gates, and Daymond John are just a few that might spring to mind. There are...

-

Presented below is selected information for Kaila Company for the month of March, 2024. Instructions a. Prepare a multiple-step income statement. b. Calculate the gross profit margin. Cost of goods...

-

The following is Crystal Companys adjusted trial balance at December 31, 2024: Instructions a. Prepare a single-step income statement for the year ended December 31, 2024. b. Prepare closing entries...

-

Marci Ling is the bookkeeper for Samco Company, Inc. Marci has been trying to get the company's balance sheet to balance. She finally got it to balance, but she still isn't sure that it is correct....

-

Design a clocked D flip-flop, using a modified ECL circuit design, such that the output becomes valid on the negative-going edge of the clock signal.

-

An L2 steel strap having a thickness of 0.125 in. and a width of \(2 \mathrm{in}\). is bent into a circular arc of radius \(600 \mathrm{in}\). Determine the maximum bending stress in the strap.

-

Cars traveling from Canada to the United States through the Thousand Islands Border Crossing must stop for US Customs and Immigration. During the stop, each passenger in the car must present a...

-

Gasoline is pumped through a 2 in. sch 40 pipeline upward into an elevated storage tank at $60^{\circ} \mathrm{F}$. An orifice meter is mounted in a vertical section of the line, which uses a DP cell...

-

Change the recurring costs in Problem and Exercise 3 to $40,000 and redo the analysis. Problem and Exercise 3 Assume you are put in charge of launching a new website for a local nonprofit...

-

During 2014, Rayon Corporation disposed of two different assets. On January 1, 2014, prior to disposal of the assets, the accounts reflected the following: The machines were disposed of in the...

-

Which should drive action planning more, strengths or weaknesses? That is, is it more important to build on your strengths or to reduce your weaknesses? Explain.

-

The following information is for Tindall Company in September: 1. Cash balance per bank, September 30, $7,100. 2. Cash balance per books, September 30, $5,470. 3. Outstanding cheques, $3,120. 4. Bank...

-

The bank portion of the bank reconciliation for Maloney Company at October 31, 2017, was as follows: The adjusted cash balance per bank agreed with the cash balance per books at October 31. The...

-

When the accountant of Trillo Company prepared the bank reconciliation on May 31, 2017, there were three outstanding cheques: #690 for $307, #693 for $179, and #694 for $264. There were no deposits...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App