Highland Cove Resort has a May 31 fiscal year end and prepares adjusting entries on a monthly

Question:

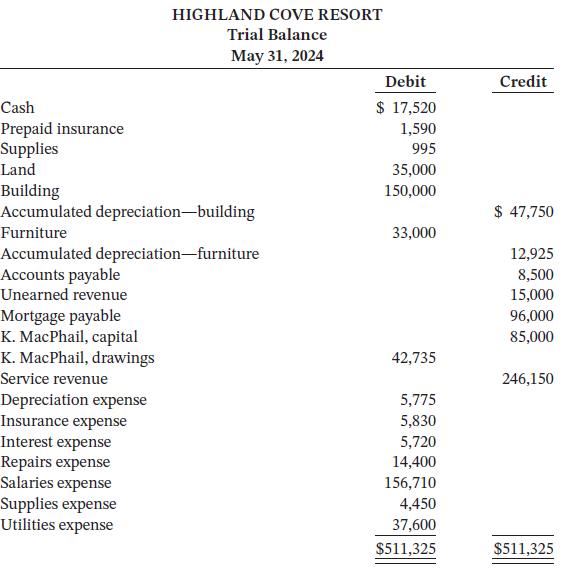

Highland Cove Resort has a May 31 fiscal year end and prepares adjusting entries on a monthly basis. The following trial balance was prepared before recording the May 31 monthly adjustments:

Additional information:

1. The company pays $6,360 for its annual insurance policy on July 31 of each year.

2. A count shows $560 of supplies on hand on May 31, 2024.

3. The building has an estimated useful life of 50 years.

4. The furniture has an estimated useful life of 10 years.

5. Services related to two-thirds of the unearned revenue have been performed.

6. The mortgage interest rate is 6.5% per year. Interest has been paid to April 30, 2024.

7. Salaries accrued to the end of May were $1,450.

8. The May utility bill of $3,420 is unrecorded and unpaid.

Instructions

a. Prepare T accounts and enter the unadjusted trial balance amounts.

b. Prepare and post the monthly adjusting entries on May 31.

c. Prepare an adjusted trial balance at May 31.

d. Prepare an income statement and a statement of owner’s equity for the year ended May 31, and a balance sheet as at May 31, 2024.

Taking It Further

Is the owner’s capital account on the May 31, 2024, adjusted trial balance the same amount as shown in the May 31, 2024, balance sheet? Why or why not?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak