In the November 30, 2024, bank reconciliation at Kirans Kayaks, there were two outstanding cheques: #165 for

Question:

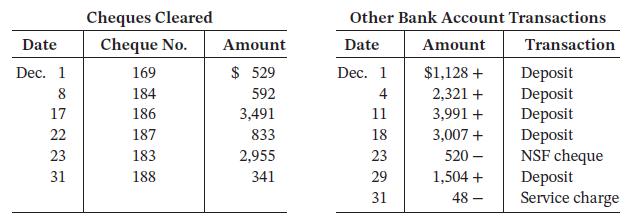

In the November 30, 2024, bank reconciliation at Kiran’s Kayaks, there were two outstanding cheques: #165 for $812 and #169 for $529. There was a $1,128 deposit in transit as at November 30, 2024. The bank balance at November 30 was $7,181; the adjusted cash balance was $6,968. The December bank statement had the following selected information:

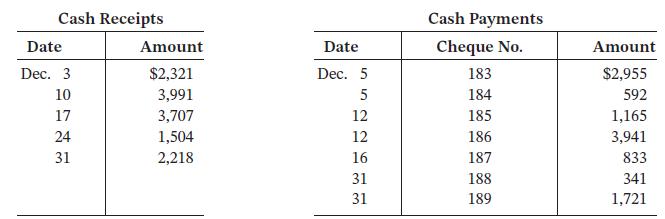

The NSF cheque was originally received from a customer, M. Sevigny, in payment of her account of $500. The bank included a $20 service charge for a total of $520. Information from the company’s accounting records follows:

Investigation reveals that cheque #186 was issued to buy equipment. All deposits are for collections of accounts receivable. The bank made no errors. The company’s policy is to pass on all NSF processing fees to the customer.

Instructions

a. Calculate the balance per bank statement at December 31 and the unadjusted cash balance per company records at December 31.

b. Prepare a bank reconciliation for Kiran’s Kayaks at December 31.

c. Prepare the necessary journal entries at December 31.

d. What balance would Kiran’s Kayaks report as cash in the current assets section of its balance sheet on December 31, 2024?

Taking It Further

Explain why it is important for Kiran’s Kayaks to complete the above bank reconciliation before preparing closing entries.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak