Jackie Enterprises Ltd. has a tax rate of 30% and reported net income of $8.5 million in

Question:

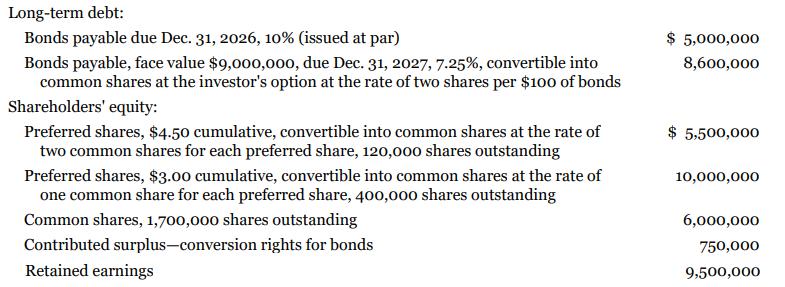

Jackie Enterprises Ltd. has a tax rate of 30% and reported net income of $8.5 million in 2020. The following details are from Jackie's statement of financial position as at December 31, 2020, the end of its fiscal year:

Other information:

1. Quarterly dividends were declared on March 1, June 1, September 1, and December 1 for the preferred shares and paid 10 days after the date of declaration.

2. Dividends paid on common shares amounted to $980,000 during the year and were paid on December 20, 2020.

3. Interest expense on bonds payable totalled $1,178,200, including bond discount amortization, which is recorded using the effective interest amortization method.

4. There were no issuances of common shares during the 2020 fiscal year, and no conversions.

Instructions

a. Determine the amount of interest expense incurred in 2020 for each of the bonds outstanding at December 31, 2020.

b. Calculate basic earnings per share for 2020. Round to the nearest cent.

c. Determine the potential for dilution for each security that is convertible into common shares.

d. Calculate diluted earnings per share for 2020. Round to the nearest cent.

e. What is the significance of the preferred share dividends being paid quarterly? What impact, if any, does this frequency in payment have on the calculation of diluted earnings per share?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy