Lu Corp. erected and placed into service an offshore oil platform on January 1, 2020 at a

Question:

Lu Corp. erected and placed into service an offshore oil platform on January 1, 2020 at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year useful life. Lu estimates that it will cost $1 million to dismantle and remove the platform at the end of its useful life and that the discount rate to use should be 8%. Using

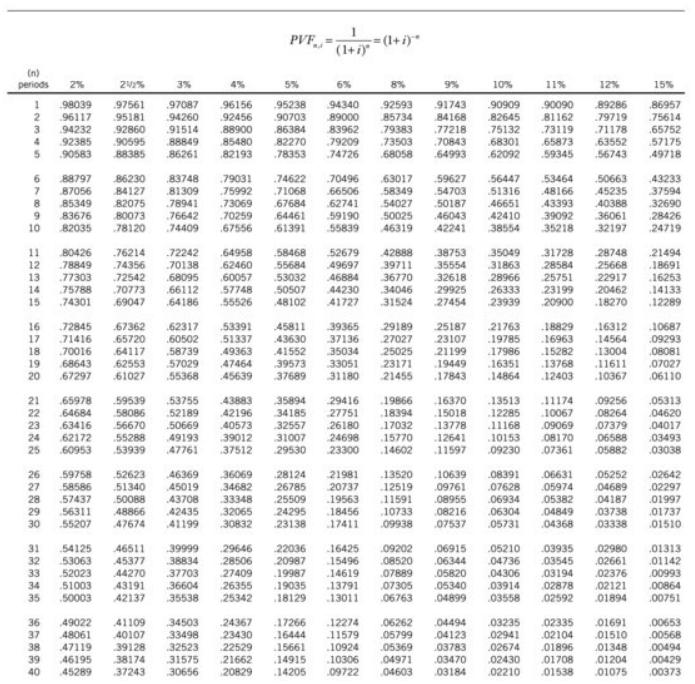

(a) Factor Table A.2,

(b) A financial calculator,

(c) Excel function PV, prepare the entry to record the asset retirement obligation. Assume that none of the $1 million cost relates to production. Round amounts to the nearest dollar.

Table A.2

PVF= (1+i) (1+i) (n) periods 2% 3% 4% 5% 6% 8% 9% 10% 11% 12% 15% 98039 96117 94232 92385 97561 .95238 91743 90909 90090 86957 97087 94260 .91514 96156 .92456 88900 85480 82193 94340 89000 83962 79209 74726 92593 85734 79383 73503 68058 89286 79719 95181 92860 90595 88385 90703 84168 77218 70843 82645 75132 68301 .62092 81162 75614 65752 57175 49718 71178 63552 3 86384 73119 88849 86261 4 82270 78353 65873 59345 5. 90583 64993 56743 88797 83748 79031 .74622 .56447 50663 86230 84127 70496 66506 63017 58349 54027 59627 54703 50187 46043 42241 53464 48166 43393 39092 43233 37594 32690 87056 81309 78941 76642 75992 73069 .71068 .51316 46651 45235 40388 36061 8 85349 83676 82035 82075 BO073 78120 70259 .67556 67684 64461 61391 62741 59190 55839 50025 46319 42410 38554 28426 10 74409 35218 32197 24719 76214 74356 72242 .64958 58468 52679 42888 38753 35049 31728 28748 21494 11 12 13 B0426 78849 77303 75788 70138 .68095 66112 62460 60057 57748 55684 53032 49697 46884 39711 36770 35554 32618 29925 31863 28966 26333 23939 28584 25751 23199 25668 22917 18691 16253 14133 72542 14 15 70773 69047 50507 48102 44230 41727 34046 31524 20462 18270 ,74301 64186 .55526 27454 20900 12289 16 72845 67362 62317 .53391 45811 39365 29189 25187 23107 21199 21763 19785 17986 16351 .14864 18829 .16312 10687 .09293 .08081 .07027 .06110 17 18 71416 70016 68643 65720 64117 62553 61027 .60502 58739 57029 51337 49363 47464 43630 41552 39573 37136 35034 33051 31180 27027 16963 15282 13768 14564 25025 13004 19 20 23171 21455 19449 .11611 67297 .55368 45639 37689 .17843 12403 .10367 21 65978 59539 53755 43883 35894 29416 19866 16370 15018 13513 12285 .11168 11174 .09256 .05313 04620 22 64684 63416 62172 58086 .52189 50669 42196 40573 39012 34185 27751 26180 24698 18394 10067 08264 .07379 06588 .05882 23 56670 32557 17032 13778 12641 11597 09069 04017 24 25 55288 53939 49193 47761 31007 29530 15770 10153 09230 08170 07361 .03493 03038 60953 37512 23300 14602 26 59758 52623 46369 45019 36069 28124 26785 25509 21981 20737 13520 10639 08391 06631 05974 05252 .04689 04187 .03738 02642 27 28 58586 .57437 56311 51340 50088 48866 34682 33348 32065 12519 11591 10733 09761 08955 .08216 .07628 06934 .02297 43708 19563 05382 .01997 29 30 42435 18456 24295 23138 06304 .05731 04849 .04368 01737 01510 55207 47674 41199 30832 17411 09938 07537 03338 31 46511 .54125 53063 39999 29646 28506 22036 20987 16425 09202 .06915 05210 03935 02980 .01313 32 33 52023 51003 50003 45377 44270 43191 42137 38834 37703 36604 15496 14619 13791 13011 .08520 .07889 07305 .06763 .06344 .05820 .05340 .04899 04736 .04306 .03914 03545 03194 02878 .02661 02376 02121 .01142 00993 00864 .00751 27409 19987 19035 18129 26355 34 35 35538 25342 03558 02592 01894 36 .17266 49022 48061 41109 40107 34503 33498 24367 12274 11579 06262 .05799 04494 04123 .03235 02335 01691 01510 01348 01204 .00653 .00568 37 38 39 23430 22529 21662 20829 16444 15661 02941 .02674 47119 46195 45289 .02104 01896 01708 .01538 39128 32523 10924 10306 09722 05369 .03783 .03470 .03184 .00494 38174 31575 .04971 00429 14915 .14205 02430 .02210 40 37243 30656 04603 01075 .00373

Step by Step Answer:

Drilling Platform 500249 Asset Retirement Obligation 1 500249 ...View the full answer

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Students also viewed these Business questions

-

Lu Corp. erects and places into service an offshore oil platform on January 1, 2011, at a cost of $10 million. Lu is legally required to dismantle and remove the platform at the end of its nine-year...

-

A robot has just been installed at a cost of $81,000. It will have no salvage value at the end of its useful life. Given the following estimates and probabilities for the yearly savings and useful...

-

On June 26, 2011, Elaine purchased and placed into service a new computer system costing $8,000. The computer system was used 80 percent for business and 20 percent for personal use in both 2011 and...

-

Use f(x) and g(x) to find a formula for each expression. Identify its domain. (a) (f + g)(x) (c) (fg)(x) (b) (f- g)(x) (d) (f/g)(x)

-

Give structural formulas for the products that you would expect from the following reactions: (a) (b) (c) (d) KMnO, heat B-Pinene H2. Pt Zingiberene HCi Caryophyllene -Selinene (1) BH3 THF (2 equiv.)...

-

ls GenMet working with a labor surplus or a labor shortage? Explain.

-

Unusual Values A person randomly chooses a World Series in which eight games were played and claims that this is an unusual event. Use the information in Exercise 28 to determine if this person is...

-

Wagner Manufacturing estimated its product costs and volume of production for 2012 by quarter as follows. Wagner Company sells a souvenir item at various resorts across the country. Its management...

-

As Managerial Accountant of the company, you are well aware that Olsen Industries, Inc. has been in the business of crafting high-quality wooden desks for nearly 30 years. As CEO of the company, I am...

-

A man is considering investing P500, 000 to open a semi-automatic auto-washing business in a city of 400, 000 population. The equipment can wash, on the average, 12 cars per hour, using two men to...

-

Cool Sound Ltd. manufactures a line of amplifiers that carry a three-year warranty against defects. Based on experience, the estimated warranty costs related to dollar sales are as follows: first...

-

Clroux Corporation sold 150 colour laser copiers in 2020 for $4,000 each, including a one-year warranty. Maintenance on each machine during the warranty period averages $300. Instructions a. Prepare...

-

What are the primary measures of long-term solvency? How are they computed? LO.1

-

Why do you think it is important to consider only relevant costs when conducting a differential analysis for a major purchase? Why not consider all possible costs in your decision? provide specific...

-

How do power dynamics and influence tactics shape decision-making processes and organizational politics within hierarchical structures ?

-

How do I answer these given the information below? Loan Amount? Loan to Value? Loan to Cost? Payment amount? Loan Balance at Maturity? Given Information: Property Cost: $1,000,000 Bank Policy on LTV:...

-

In your initial post, first do the following: Use scholarly references to define Project Management (PM), Systems Development Life Cycle (SDLC), and Application Life Cycle (AL). Then, in the same...

-

How do concepts of diversity and inclusion vary across different cultural and geographical contexts, and what strategies can multinational organizations employ to navigate these variations...

-

Commercial kerosene is stocked in a bulk tank at the beginning of each week. Because of limited supplies, the proportion X of the capacity of the tank available for sale and the proportion Y of the...

-

An annual report of The Campbell Soup Company reported on its income statement $2.4 million as equity in earnings of affiliates. Journalize the entry that Campbell would have made to record this...

-

A combined statement of income and retained earnings for DC 5 Ltd. for the year ended December 31, 2020, follows. (As a private company, DC 5 has elected to follow ASPE.) Also presented are three...

-

The following is information for Gottlieb Corp. for the year ended December 31, 2020: The effective tax rate is 25% on all items. Gottlieb prepares financial statements in accordance with IFRS. The...

-

Mega Inc.s manufacturing division lost $100,000 (net of tax) for the year ended December 31, 2020, and Mega estimates that it can sell the division at a loss of $200,000 (net of tax). The division...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App