Minerva Companys year end is December 31. Minerva prepares adjusting entries to accrue interest revenue annually. On

Question:

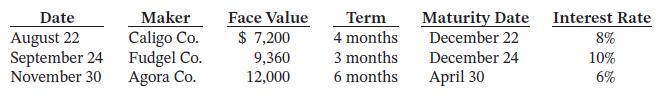

Minerva Company’s year end is December 31. Minerva prepares adjusting entries to accrue interest revenue annually. On November 30, the Notes Receivable account balance is $28,560 and the Credit Card Receivables account balance is zero. Notes receivable are as follows:

During December, the following transactions were completed:

December 5 Made sales of $5,400 on Minerva credit cards.

14 Made sales of $720 on Visa credit cards. The credit card service charge is 4%.

22 Received payment in full from Caligo Co. on the amount due.

24 Received payment in full from Fudgel Co. on the amount due.

Instructions

a. Prepare journal entries for the December transactions and the December 31 adjusting entry for accrued interest revenue. (omit cost of goods sold entries.)

b. Prepare T accounts for Notes Receivable and Credit Card Receivables and enter the balances at November 30. Post the entries prepared in part (a).

c. Show the balance sheet presentation of the receivable accounts at December 31, 2024.

Taking It Further

Minerva’s management is wondering if they should discontinue the use of the Minerva credit card and instead accept Visa and Mastercard in payment for their goods. Discuss the pros and cons for Minerva if they continue to use their own credit card. What would you recommend the company do?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak