Natalie had a very busy May. At the end of the month, after Natalie has journalized and

Question:

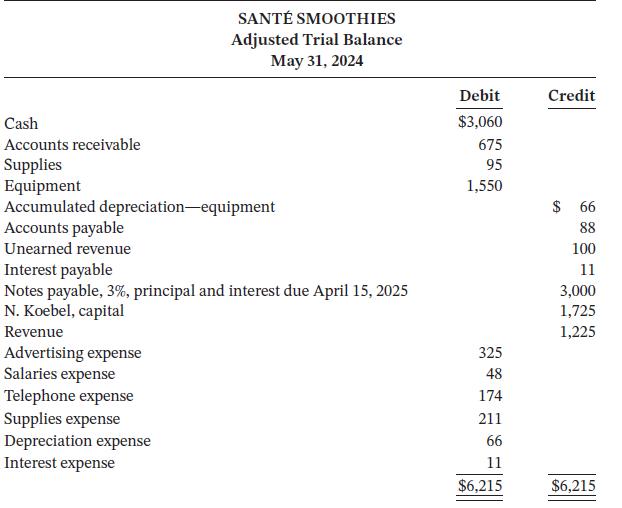

Natalie had a very busy May. At the end of the month, after Natalie has journalized and posted her adjusting and correcting entries, she has prepared an adjusted trial balance.

Instructions

Using the information in the adjusted trial balance, do the following:

a. Prepare an income statement for the two months ended May 31, 2024.

b. Prepare a statement of owner’s equity for the two months ended May 31, 2024, and a classified balance sheet at May 31, 2024.

c. Calculate Santé Smoothies’ working capital, current ratio, and acid-test ratio. Comment on Santé Smoothies’ liquidity.

d. Natalie has decided that her year end will be May 31, 2024. Prepare closing entries.

e. Prepare a post-closing trial balance.

f. Natalie had reviewed her unadjusted trial balance prior to preparing the adjusting journal entries. When Natalie initially recorded the purchase of the equipment in May for $725, she thought the equipment should be recorded as “supplies expense.” After posting the original transaction, Natalie reviewed her accounting textbook, and remembered that the purchase of equipment should be recorded as an asset. She then made an entry to correct this error. Had she not made a correcting entry, would the financial statements have been misstated? How?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak