On 1 August 20X5, Graham Ltd. decided to discontinue the operations of its services division. The services

Question:

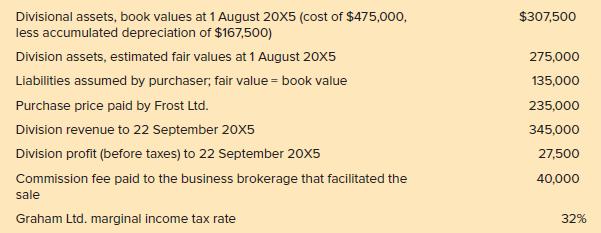

On 1 August 20X5, Graham Ltd. decided to discontinue the operations of its services division. The services division is not a separate corporation, but it is a major operating segment, financially and operationally. On 22 September 20X5, Graham closed a deal to sell the division to Frost Ltd. Frost will assume responsibility for the current liabilities (e.g., accounts payable and accrued liabilities) that pertain to the division. The facts pertaining to the sale are as follows:

On 31 December 20X5, the after tax net income, including the services division, was $300,000.

On 31 December 20X5, the after tax net income, including the services division, was $300,000.

REQUIRED:

1. Give the entries to record the (a) reclassification and (b) sale of the services division.

2. Complete the 20X5 income statement, starting with income from continuing operations, after tax.

3. Explain what other disclosures and/or reclassifications are necessary in the 20X4 comparative financial statements and notes.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9780071338820

6th Edition

Authors: Thomas Beechy, Joan Conrod, Elizabeth Farrell, Ingrid McLeod-Dick