Refer to E18.7 for Sayaka Tar and Gravel Ltd., and assume the same facts for the fiscal

Question:

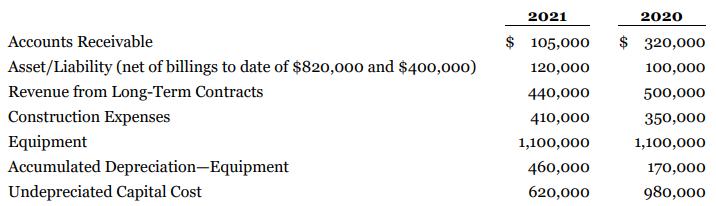

Refer to E18.7 for Sayaka Tar and Gravel Ltd., and assume the same facts for the fiscal year ended December 31, 2020. For the second year of operations, Sayaka made progress on the construction of the road for the municipality. The account balances at December 31, 2021 for the construction project and the accounting and tax balances of accounts related to the equipment used for construction follow. (The balances at December 31, 2020, are also listed.)

Sayaka's tax rate continues to be 25% for 2021 and subsequent years. Income before income tax for the year ended December 31, 2021, was $120,000.

Instructions

a. Calculate the deferred tax asset or liability balances at December 31, 2021.

b. Calculate taxable income and income tax payable for 2021.

c. Prepare the journal entries to record income taxes for 2021.

d. Prepare a comparative income statement for 2020 and 2021, beginning with the line “Income before income tax.”

e. Provide the comparative balance sheet presentation for any resulting deferred tax balance sheet accounts at December 31, 2020 and 2021. Be specific about the classification.

f. Repeat the balance sheet presentation in part (e) assuming Sayaka follows ASPE

Data From E18.7.

Sayaka Tar and Gravel Ltd. operates a road construction business. In its first year of operations, the company won a contract to build a road for the municipality of Cochrane West. It is estimated that the project will be completed over a three-year period starting in June 2020. Sayaka uses the percentage-of-completion method of recognizing revenue on its long-term construction contracts. For tax purposes, and in order to postpone the tax on such revenue for as long as possible, Sayaka uses the completed-contract method allowed by the CRA. By its first fiscal year end, the accounts related to the contract had the following balances:

Accounts Receivable............................................................$320,000

Contract Asset/Liability (net of billings to date of $400,000)......100,000

Revenue from Long-Term Contracts...................................500,000

Construction Expenses.........................................................350,000

The accounts related to the equipment that Sayaka purchased to construct the road had the following balances at the end of the first fiscal year ended December 31, 2020, for accounting and tax purposes:

Equipment................................................................$1,100,000

Accumulated Depreciation—Equipment...................170,000

Undepreciated Capital Cost.........................................980,000

Sayaka's tax rate is 25% for 2020 and subsequent years. Income before income tax for the year ended December 31, 2020, was $195,000. Sayaka reports under IFRS.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy