Roper Corporation had the following tax information: In 2020, Roper suffered a net operating loss of $550,000,

Question:

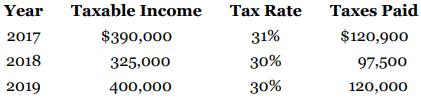

Roper Corporation had the following tax information:

In 2020, Roper suffered a net operating loss of $550,000, which it decided to carry back. The 2020 enacted tax rate is 25%. Prepare Roper's entry to record the effect of the loss carryback.

Transcribed Image Text:

Year Taxable Income Tax Rate Taxes Paid 2017 $390,000 31% $120,900 2018 325,000 30% 97,500 2019 400,000 30% 120,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (12 reviews)

Income Tax Receivabl...View the full answer

Answered By

PALASH JHANWAR

I am a Chartered Accountant with AIR 45 in CA - IPCC. I am a Merit Holder ( B.Com ). The following is my educational details.

PLEASE ACCESS MY RESUME FROM THE FOLLOWING LINK: https://drive.google.com/file/d/1hYR1uch-ff6MRC_cDB07K6VqY9kQ3SFL/view?usp=sharing

3.80+

3+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted:

Students also viewed these Business questions

-

Roper Corporation had the following tax information: In 2017, Roper suffered a net operating loss of $550,000, which it decided to carry back. The 2017 enacted tax rate is 25%. Prepare Roper's entry...

-

Ayesha Corporation had the following tax information: In 2011, Ayesha suffered a net operating loss of $550,000, which it decided to carry back. The 2011 enacted tax rate is 29%. Prepare Ayesha's...

-

Nolan Corporation had the following tax information. In 2021, Nolan suffered a net operating loss of $480,000, which it elected to carryback. The 2021 enacted tax rate is 29%. Prepare Nolan?s entry...

-

Describe what this statement does: print user name = + userName

-

Additional evidence for the halogenation mechanisms that we just presented comes from the following facts: (a) Optically active 2-methyl-1-phenylbutan-1-one undergoes acid-catalyzed racemization at a...

-

Ethics and Pressure to Improve Profit Plans (LO1) Art Conroy is the assistant controller of New City Muffler, Inc., a subsidiary of New City Automotive, which manufactures tailpipes, mufflers, and...

-

State whether the following statements are true or false: (a) Purchase of equipment on account is first recorded in the Purchased Day Book. (b) Sales Returns Account is a Personal Account. (c) Sale...

-

The following information was drawn from the annual report of Sierra Home Builders (SHB). Required a. Compute the percentage of growth in net income from 2016 to 2017. Can stockholders expect a...

-

4. You are given: (a) The force of mortality is constant at 4%. (b) The force of interest & is constant at 6%. Calculate the actuarial present value of a continuous annuity with 10 year guar- anteed...

-

The Prompt Corporation purchases product from two suppliers, A and B. Supplier A is located in Austin, TX, and supplier B in Carthage, TN. Supplier A supplies component a and supplier B supplies...

-

Zdon Inc. reports accounting income of $105,000 for 2020, its first year of operations. The following items cause taxable income to be different than income reported on the financial statements. 1....

-

Jenny Corporation recorded warranty accruals as at December 31, 2020, in the amount of $150,000. This reversing difference will cause deductible amounts of $50,000 in 2021, $35,000 in 2022, and...

-

A firm purchases 100 acres of land for $200,000 and agrees to remit 20 equal annual end-of- year installments of $41,067 each. What is the true annual interest rate on this loan?

-

Allison, Inc., produces two products, X and Y, in a single joint process. Last month the joint costs were P75,000 when 10,000 units of Product X and 15,000 units of Product Y were produced....

-

8+0.5 = 4. Consider a system with a lead compensator Ge(s) = +0.13 followed by a plant G(s) = 10 Determine a value for a gain K on the error signal such that the phase margin s(s+1) of the open-loop...

-

Standard Normal Distribution. In Exercises 17-36, assume that a randomly selected subject is given a bone density test. Those test scores are normally distributed with a mean of 0 and a standard...

-

After making several improvements in the east process, you now want to put controls in place to detect new problems if they occur. To help with this, the workers collected a sample of 5 capsules each...

-

Help es ! Required information The box shown has cardboard sides and wood strips along the edges and from corner to corner. The strength of the box is provided primarily by the wood strips, and a...

-

Reaction to tear gas. The length of time Y (in minutes) required to generate a human reaction to tear gas formula A has a gamma distribution with = 2 and = 2. The distribution for formula B is also...

-

Subprime loans have higher loss rates than many other types of loans. Explain why lenders offer subprime loans. Describe the characteristics of the typical borrower in a subprime consumer loan.

-

Ali Reiners, the new controller of Luftsa Corp., is preparing the financial statements for the year ended December 31, 2023. Luftsa is a publicly traded entity and therefore follows IFRS. Ali has...

-

Kitchener Corporation has followed IFRS and used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a...

-

Matusek Corporation has been experiencing a higher than expected number of warranty claims in the current year, due mainly to less than ideal product design. For this reason, the warranty expense...

-

Docs Auto Body has budgeted the costs of the following repair time and parts activities for 2009: Doc's budgets 6,000 hours of repair time in 2009. A profit margin of $7 per labour hour will be added...

-

QUESTION 28 In a perpetual inventory system, the cost of inventory sold is: Debited to accounts receivable. Debited to cost of goods sold. O Not recorded at the time goods are sold. O Credited to...

-

The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $105,709 69,500 66,800 4,700 246,700 127,eee...

Study smarter with the SolutionInn App