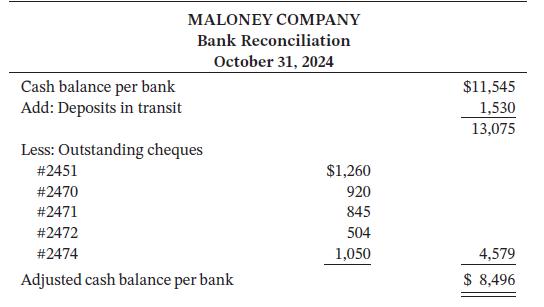

The bank portion of the bank reconciliation for Maloney Company at October 31, 2024, was as follows:

Question:

The bank portion of the bank reconciliation for Maloney Company at October 31, 2024, was as follows:

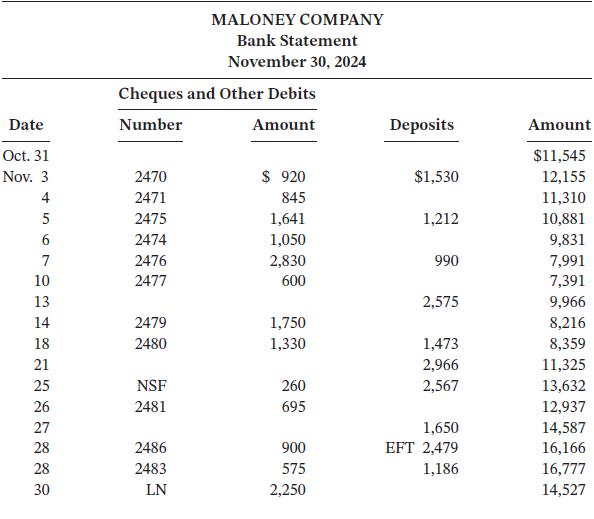

The adjusted cash balance per bank agreed with the cash balance per books at October 31. The November bank statement showed the following:

Additional information from the bank statement:

1. The EFT of $2,479 is an electronic transfer from a customer in payment of its account. The amount includes $49 of interest that Maloney Company had not previously accrued.

2. The NSF for $260 is a $245 cheque from a customer, Pendray Holdings, in payment of its account, plus a $15 processing fee. The company’s policy is to pass on all NSF service charges to the customer.

3. The LN is a payment of a note payable with the bank and consists of $250 interest and $2,000 principal.

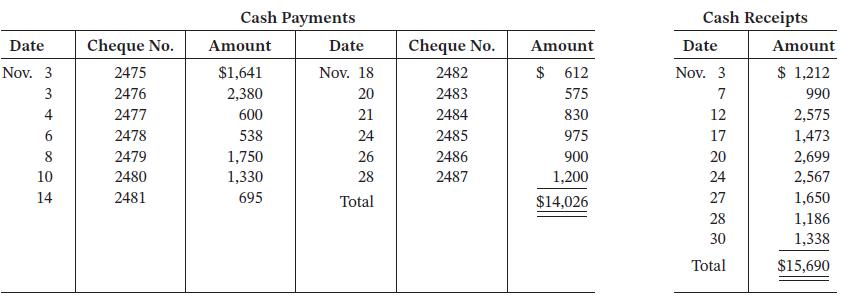

4. At November 30, the cash balance per books was $10,160. The bank did not make any errors. The cash records per books for November follow. Two errors were made by Maloney Company.

Instructions

a. Prepare a bank reconciliation at November 30.

b. Prepare the necessary journal entries at November 30.

Taking It Further

When there is an error, how does a company determine if it was a bank error or a company error? How would you know if the bank has made an error in your account?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak