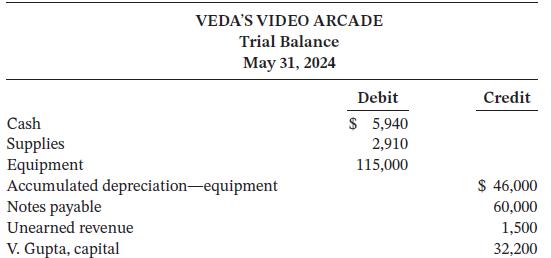

The unadjusted trial balance for Vedas Video Arcade at its fiscal year end of May 31, 2024,

Question:

The unadjusted trial balance for Veda’s Video Arcade at its fiscal year end of May 31, 2024, is as follows:

Additional information:

1. On May 31, 2024, Veda’s Video Arcade had provided services but not collected or recorded $750 of revenue. On June 19, 2024, it collected this amount plus an additional $1,150 for revenue to be recognized in June.

2. There was $765 of supplies on hand on May 31, 2024.

3. The equipment has an estimated useful life of 10 years.

4. Accrued salaries to May 31 were $1,390. The next payday is June 2 and the employees will be paid a total of $1,980 that day.

5. The note payable has a 6% annual interest rate. Interest is paid monthly on the first day of the month.

6. As at May 31, 2024, there was $700 of unearned revenue.

Instructions

a. Prepare adjusting journal entries for the year ended May 31, 2024, as required.

b. Prepare reversing entries where appropriate.

c. Prepare journal entries to record the June 2024 cash transactions.

d. Now assume reversing entries were not prepared as in part (b) above. Prepare journal entries to record the June 2024 cash transactions.

Taking It Further

Why is it not appropriate to use reversing entries for all of the adjusting entries?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak