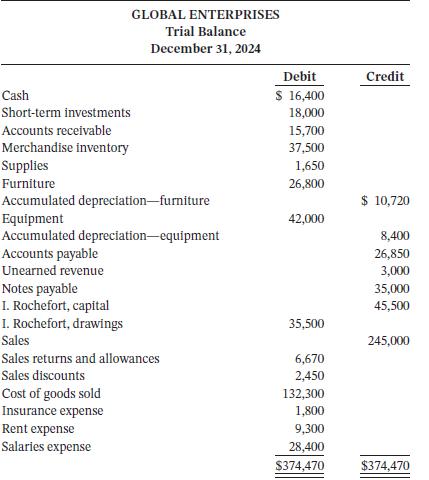

The unadjusted trial balance of Global Enterprises for the year ended December 31, 2024, follows: Additional information:

Question:

The unadjusted trial balance of Global Enterprises for the year ended December 31, 2024, follows:

Additional information:

1. There was $700 of supplies on hand on December 31, 2024.

2. Depreciation expense for the year is $5,360 on the furniture, and $4,200 on the equipment

3. Accrued interest expense at December 31, 2024, is $1,750.

4. Accrued interest revenue at December 31, 2024, is $720.

5. Of the unearned revenue, $1,600 is still unearned at December 31, 2024. On the amount that was earned, the cost of goods sold was $755.

6. A physical count of merchandise inventory indicates $35,275 on hand on December 31, 2024.

7. Global Enterprises uses the perpetual inventory system and the earnings approach.

Instructions

a. Prepare the adjusting entries assuming they are prepared annually and update account balances.

b. Prepare a multiple-step income statement.

c. Prepare a single-step income statement.

d. Prepare the closing entries.

Taking It Further

Compare the single-step and multiple-step income statements and comment on the usefulness of each. In your comments, refer to specific details related on Global Enterprises’ income statements.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak