Top Light Company uses a perpetual inventory system. The company began 2024 with 1,000 lamps in inventory

Question:

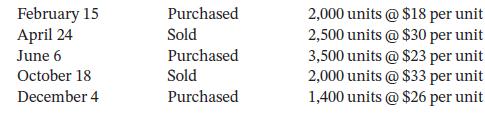

Top Light Company uses a perpetual inventory system. The company began 2024 with 1,000 lamps in inventory at a cost of $12 per unit. During 2024, Top Light had the following purchases and sales of lamps:

All purchases and sales are on account.

Instructions

a. Calculate the cost of goods sold and ending inventory using weighted average. Round the weighted average cost per unit to two decimal places.

b. Prepare journal entries to record the June 6 purchase and the October 18 sale.

c. Calculate gross profit for the year.

February 15 April 24 June 6 October 18 December 4 Purchased Sold Purchased Sold Purchased 2,000 units @ $18 per unit 2,500 units @ $30 per unit 3,500 units @ $23 per unit 2,000 units @ $33 per unit 1,400 units @ $26 per unit

Step by Step Answer:

a Weighted average b c Date Units Cost Beginning inventory 1000 1200 Feb 1...View the full answer

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Top Light Company uses a perpetual inventory system. The company began 2021 with 1,000 lamps in inventory at a cost of $12 per unit. During 2021, Top Light had the following purchases and sales of...

-

Top Light Company uses a perpetual inventory system. The company began 2017 with 1,000 lamps in inventory at a cost of $12 per unit. During 2017, Top Light had the following purchases and sales of...

-

Top Light Company uses a perpetual inventory system. The company began 2014 with 1,000 lamps in inventory at a cost of $12 per unit. During 2014, Top Light had the following purchases and sales of...

-

Cinderella's income increases by 25%. She decides to increase her purchases of glass slippers by 40%. To her, glass slippers are a(n)____________good and her income elasticity of demand for glass...

-

Stackhouse International, Inc., completed its first year of operations on June 30, 2010. The firms income statement for the year showed revenues of $250,000 and operating expenses of $75,000....

-

A 20- resistor is connected to four 1.5-V batteries. What is the joule heat loss per minute in the resistor if the batteries are connected (a) In series and (b) In parallel?

-

Madison Seniors Care Center is a nonprofit organization that provides a variety of health services to the elderly. The center is organized into a number of departments, one of which is the...

-

Questions to Answer: How might Elaine minimize the tax implication of C Corporation status? What advice would you give to Elaine in choosing her business entity form? Required information Entity...

-

Misu Sheet, owner of the Bedspread Shop, knows his customers will pay no more than $145 for a comforter. Misu Sheet wants to advertise the comforter as "percent markup on cost." a. What is the...

-

Determine expressions for the mean residence time given "outward" diffusional release into a perfect sink from a) A cylindrical monolithic device of radius a, with ends capped. b) A spherical device...

-

The following financial information (in US$ millions) is for two major corporations for the three fiscal years ended December 31 as follows: Instructions a. Calculate the inventory turnover, days...

-

Harrison Company has a July 31 fiscal year end and uses a perpetual inventory system. The records of Harrison Company show the following data: After its July 31, 2024, year end, Harrison discovered...

-

Show that \[\sum_{i=1}^{n}\left(x_{i}-\bar{x} ight)=0\] for any set of observations $x_{1}, x_{2}, \ldots, x_{n}$.

-

Financial Reporting Problem: Columbia Sportswear Company The financial statements for the Columbia Sportswear Company can be found in Appendix A at the end of this book. The following selected...

-

The retained earnings on a balance sheet are \(\$ 80,000\). Without seeing the rest of the balance sheet, can you conclude that stockholders should be able to receive a dividend in the amount of \(\$...

-

Determine the missing amount in each of the following cases: Assets Liabilities Stockholders' Equity $350,000 $155,000 ? $95,000 $225,000 ? ? $40,000 $ 59,000

-

Construct a 5-to-32-line decoder with four 3-to-8-line decoders with enable and one 2-to-4-line decoder. Use block diagrams similar to Fig. 2-3. Fig. 2-3 Ao A A 2 21 E 2 21 E 2x4 decoder 2x4 decoder...

-

After reconciling its bank account, Obian Company made the following adjusting entries: Required Identify the event depicted in each journal entry as asset source (AS), asset use (AU), asset exchange...

-

Assume you recently obtained a job with Perfumania, the largest specialty retailer of discounted fragrances in the United States. Your job is to estimate the amount of write-down required to value...

-

Refer to the information from Exercise 22-19. Use the information to determine the (1) Weighted average contribution margin , (2) Break-even point in units, and (3) Number of units of each product...

-

On June 9, 2016, Blue Ribbon Company purchased manufacturing equipment at a cost of $345,000. Blue Ribbon estimated that the equipment will produce 600,000 units over its five-year useful life, and...

-

On April 22, 2016, Sandstone Enterprises purchased equipment for $129,200. The company expects to use the equipment for 12,000 working hours during its four-year life and that it will have a residual...

-

Bisor Company has a December 31 year end and uses straight-line depreciation for all property, plant, and equipment. On July 1, 2015, the company purchased equipment for $500,000. The equipment had...

-

Each week you must submit an annotated bibliography. Entries of current events relating to the economic concepts and the impact on the company or the industry of your company. You must use acceptable...

-

Fluffy Toys Ltd produces stuffed toys and provided you with the following information for the month ended August 2020 Opening WIP Units 5,393 units Units Started and Completed 24,731 units Closing...

-

Part A Equipment 1,035,328 is incorrect Installation 44,672 is incorrect Anything boxed in red is incorrect sents 043/1 Question 9 View Policies Show Attempt History Current Attempt in Progress...

Study smarter with the SolutionInn App