Up North Company recently hired a new accountant whose first task was to prepare the financial statements

Question:

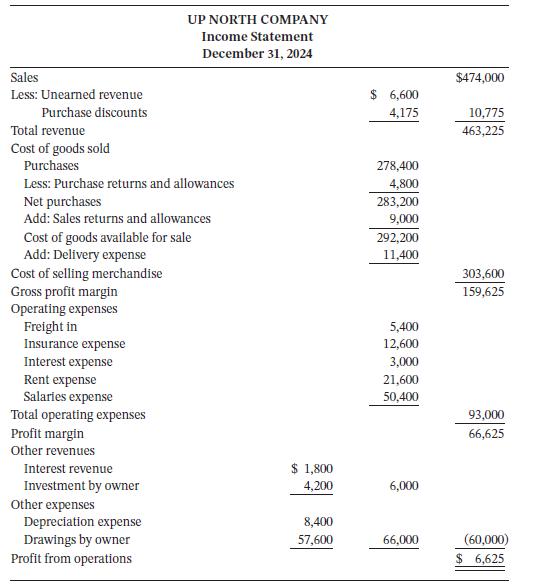

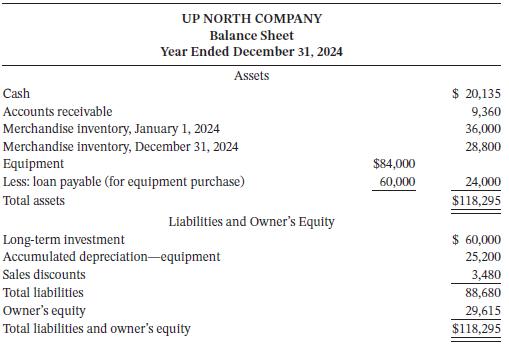

Up North Company recently hired a new accountant whose first task was to prepare the financial statements for the year ended December 31, 2024. The following is what she produced:

The owner of the company, James Prideaux, is confused by the statements and has asked you for your help. He doesn’t understand how, if his Owner’s Capital account was $90,000 at December 31, 2023, owner’s equity is now only $29,615. The accountant tells you that $29,615 must be correct because the balance sheet is balanced. The accountant also tells you that she didn’t prepare a statement of owner’s equity because it is an optional statement. You are relieved to find out that, even though there are errors in the statements, the amounts used from the accounts in the general ledger are the correct amounts.

Instructions

Prepare the correct multiple-step income statement, statement of owner’s equity, and classified balance sheet. You determine that $6,000 of the loan payable on the equipment must be paid during 2025. Up North Company uses the periodic inventory system with the earnings approach.

Taking It Further

Why do we not include both the beginning and the ending merchandise inventory amounts on the balance sheet?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak