Actuarial Gains and Losses: The following information relates to the pension plan of CCL Corporation, which has

Question:

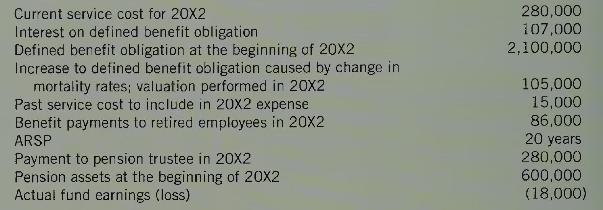

Actuarial Gains and Losses: The following information relates to the pension plan of CCL Corporation, which has a contributory defined benefit pension plan:

The following cases are independent.

Case \(A\)

CCL includes expected earnings at a rate of \(4 \%\) in the calculation of pension expense. Opening unrecognized actuarial losses were \(\$ 340,000\) and the company uses the \(10 \%\) corridor method based on opening balances.

Case \(B\)

CCL includes expected earnings at a rate of \(4 \%\) in the calculation of pension expense. Opening unrecognized actuarial losses were \(\$ 340,000\) and the company is amortizing the full opening balance of actuarial gains or losses to pension expense over the ARSP, with no reference to a corridor.

Case \(C\)

CCL includes expected earnings at a rate of \(4 \%\) in the calculation of pension expense. Opening unrecognized actuarial losses were \(\$ 340,000\) and the company is using a \(10 \%\) corridor approach, with any excess actuarial gains or losses amortized to earnings over five years.

Case \(D\)

CCL includes expected earnings at a rate of \(4 \%\) in the calculation of pension expense. Actuarial gains and losses are included in pension expense in the year they arise. There was no opening balance of unrecognized actuarial gains or losses.

Case \(E\)

CCL includes expected earnings at a rate of \(4 \%\) in the calculation of pension expense. Actuarial gains and losses are recorded as an adjustment to reserves and included as an element of other comprehensive income in the year they arise. There was no opening balance of unrecognized actuarial gains or losses.

Required:

For each case

1. Compute \(20 \mathrm{X} 2\) pension expense.

2. Give the 20X2 entry(ies) for CCL Company to record pension expense (and other adjustments in Case \(E\) ) and funding.

Step by Step Answer: