Car Wash Ltd. began a pension fund in the year 20X3, effective 1 January 20X4. Terms of

Question:

Car Wash Ltd. began a pension fund in the year 20X3, effective 1 January 20X4. Terms of the pension plan follow:

• The yield rate on long-term high-grade corporate bonds is 5%.

• Employees will receive partial credit for past service. The past service obligation, valued using the projected unit credit actuarial cost method and a discount rate of 5%, is $416,000 as of 1 January 20X4.

• Past service cost will be funded over roughly 15 years. The initial payment, on 1 January 20X4, is $90,000. This will earn interest in 20X4. After that, another $90,000 will be added to the 31 December funding payment each year for past service, including the 31 December 20X4 payment. The amount of funding will be reviewed every five years to ensure its adequacy.

• Current service cost will be fully funded each 31 December, plus actuarial losses or minus actuarial gains of the year, if those actuarial gains or losses are related to the defined benefit obligation. Experience gains and losses related to the difference between actual and expected earnings on fund assets will not affect plan funding in the short run, as they are expected to offset over time.

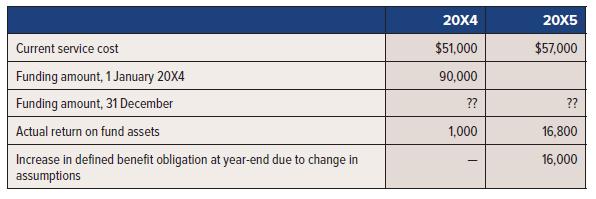

Data for 20X4 and 20X5:

Required:

Prepare a spreadsheet for 20X4 and 20X5 that determines pension expense and also the closing net defined benefit asset or liability account and accumulated OCI.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel