(Change from Fair Value to Equity Method) On January 3, 2005, Calvin Company purchased for $500,000 cash...

Question:

(Change from Fair Value to Equity Method) On January 3, 2005, Calvin Company purchased for $500,000 cash a 10% interest in Hobbes Corp. On that date the net assets of Hobbes had a book value of $3,750,000. The excess of cost over the underlying equity in net assets is attributable to undervalued depreciable assets having a remaining life of 10 years from the date of Calvin’s purchase.

The fair value of Calvin’s investment in Hobbes securities is as follows: December 31, 2005, $570,000, and December 31, 2006, $515,000.

On January 2, 2007, Calvin purchased an additional 30% of Hobbes’s stock for $1,545,000 cash when the book value of Hobbes’s net assets was $4,150,000. The excess was attributable to depreciable assets having a remaining life of 8 years.

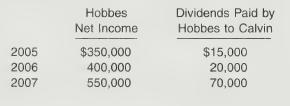

During 2005, 2006, and 2007 the following occurred.

Instructions On the books of Calvin Company prepare all journal entries in 2005, 2006, and 2007 that relate to its investment in Hobbes Corp., reflecting the data above and a change from the fair value method to the equity method.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield