(Change in Estimate and Error Correction) Brueggen Company is in the process of preparing its financial statements...

Question:

(Change in Estimate and Error Correction) Brueggen Company is in the process of preparing its financial statements for 2007. Assume that no entries for depreciation have been recorded in 2007. The following information related to depreciation of fixed assets is provided to you:

1. Brueggen purchased equipment on January 2, 2004, for $65,000. At that time, the equipment had an estimated useful life of 10 years with a $5,000 salvage value. The equipment is depreciated on a straight-line basis. On January 2, 2007, as a result of additional information, the company determined that the equipment has a remaining useful life of 4 years with a $3,000 salvage value.

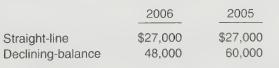

2. During 2007 Brueggen changed from the double-declining balance method for its building to the straight-line method. The building originally cost $300,000. It had a useful life of 10 years and a salvage value of $30,000. The following computations present depreciation on both bases for 2005 and 2006.

3. Brueggen purchased a machine on July 1, 2005, at a cost of $80,000. The machine has a salvage value of $8,000 and a useful life of 8 years. Brueggen’s bookkeeper recorded straight-line depreciation in 2005 and 2006 but failed to consider the salvage value.

Instructions

(a) Prepare the journal entries to record depreciation expense for 2007 and correct any errors made to date related to the information provided. (Round all computations to two decimal places.)

(b) Show comparative net income for 2006 and 2007. Income before depreciation expense was $300,000 in 2007, and was $310,000 in 2006. Ignore taxes.

Step by Step Answer:

Intermediate Accounting 2007 FASB Update Volume 2

ISBN: 9780470128763

12th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield