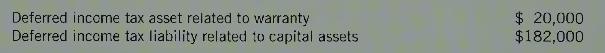

Change in Tax Rates: On December 31, 20X6, Silk Corporation reported the following amounts on the statement

Question:

Change in Tax Rates: On December 31, 20X6, Silk Corporation reported the following amounts on the statement of financial position:

On this date, the net book value of capital assets was \(\$ 1,380,000\) and undepreciated capital cost was \(\$ 980,000\). There was an estimated warranty liability of \(\$ 10,000\).

In \(20 X 7\), accounting income was \(\$ 1,600,000\). This included golf club dues of \(\$ 22,000\), depreciation of \(\$ 200,000\), and a warranty expense of \(\$ 90,000\). Warranty claims paid were \(\$ 60,000\) and CCA was \(\$ 300,000\).

Required:

1. Provide the journal entry to record tax expense in \(20 X 7\). The enacted tax rate was \(40 \%\) in \(20 \times 7\).

2. Identify the following balances for December 31, 20X7:

a. Deferred income tax asset.

b. Deferred income tax liability.

c. Estimated warranty liability.

d. Net book value of capital assets.

e. Undepreciated capital cost.

Step by Step Answer: