Cruz Inc., a publicly traded company, had the following balances in its shareholders equity accounts at the

Question:

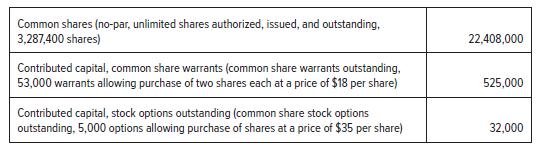

Cruz Inc., a publicly traded company, had the following balances in its shareholders’ equity accounts at the beginning of 20X3:

The following transactions took place during the year:

1. At the beginning of 20X3, all 53,000 warrants were exercised when the market value of the shares was $25 per share.

2. A consultant provided services to Cruz Inc. Cruz and the consultant negotiated stock options as the form of payment. The options allow the consultant to purchase 8,500 shares at a price of $20 per share, beginning next year (20X4). Had the options not be issued, the consultant would have charged $125 per hour. A total of 1,120 hours were incurred during the year.

3. 15,000 stock options were issued for proceeds of $95,400, allowing purchase of 15,000 shares at a price of $21 per share.

4. 10,000 of the options issued in transaction 3 above were exercised when the market value of the shares was $31.

5. 5,000 stock options that were issued in 20X2 expired during the year. The stock options allowed the holder to acquire common shares at an acquisition price of $35 per share.

6. Options were issued to existing shareholders. The options allow the purchase of 10 shares for each existing share held at a price of $5 each. The options are exercisable only under certain limited conditions.

Required:

1. Provide journal entries for each of the transactions listed above.

2. Calculate the ending balance for each equity account, using the information recorded in requirement 1.

3. What items would appear on the statement of cash flows in the financing activities section as a result of the changes in the equity accounts?

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel