Ding Solutions Limited is authorized to issue unlimited numbers of common shares, of which (1,675,000) have been

Question:

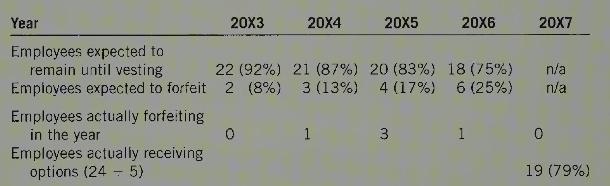

Ding Solutions Limited is authorized to issue unlimited numbers of common shares, of which \(1,675,000\) have been issued at an average price of \(\$ 75\) per share. On 1 January 20X3, the company granted stock options to each of its 24 senior executives. The stock options provide that each individual will be eligible to purchase, no earlier than 31 December 20X7, 2,000 common shares at a base option price of \(\$ 110\) per share. The options are non-transferable, vest on 31 December \(20 X 7\), and expire on 31 December 20X8. Option pricing models indicate that the options have a total value of \(\$ 900,000\). Estimates of retention:

Sixteen individuals who received the options exercised on 31 December \(20 X 7\), when the share price was \(\$ 168\). The remaining individuals did not exercise the options. The share price fell to \(\$ 105\) in \(20 \times 8\) and the options lapsed.

Required:

1. Prepare the entries to record the granting of the options, annual expense, exercise, and lapse.

2. Why is the compensation expense not an equal amount each year? Be specific.

3. What intrinsic value was received when the options were exercised? Is this reflected in the financial statements? Explain.

Step by Step Answer: